Can You Convert 401k To Roth Ira

Same goes for a Roth 401k-to-Roth IRA rollover. The tax structure is staying the same.

How To Access Retirement Funds Early

How To Access Retirement Funds Early

This means that when you convert a 401 k to a Roth IRA you must pay ordinary income tax on the account balance.

Can you convert 401k to roth ira. Its permitted by the IRS but not all employers participate. See Publication 590-A Contributions to Individual Retirement Arrangements IRAs for more information. Note however that you typically cannot convert a 401 k to a Roth IRA while you are still working for the employer where your 401 k is held.

If you cant convert consider making your future 401 k contributions to a. If you have a traditional 401k plan that means you didnt pay taxes on the money when you contributed it to your account. And a lot of folks simply feel more comfortable with a this more vanilla investment choice.

If you do a Roth IRA conversion youll owe income. Converting a 401 k to a Roth IRA is essentially the same process as rolling your 401 k funds over to a traditional IRA but theres the extra step. However some employers do permit an in-service rollover where you can do the rollover while still employed.

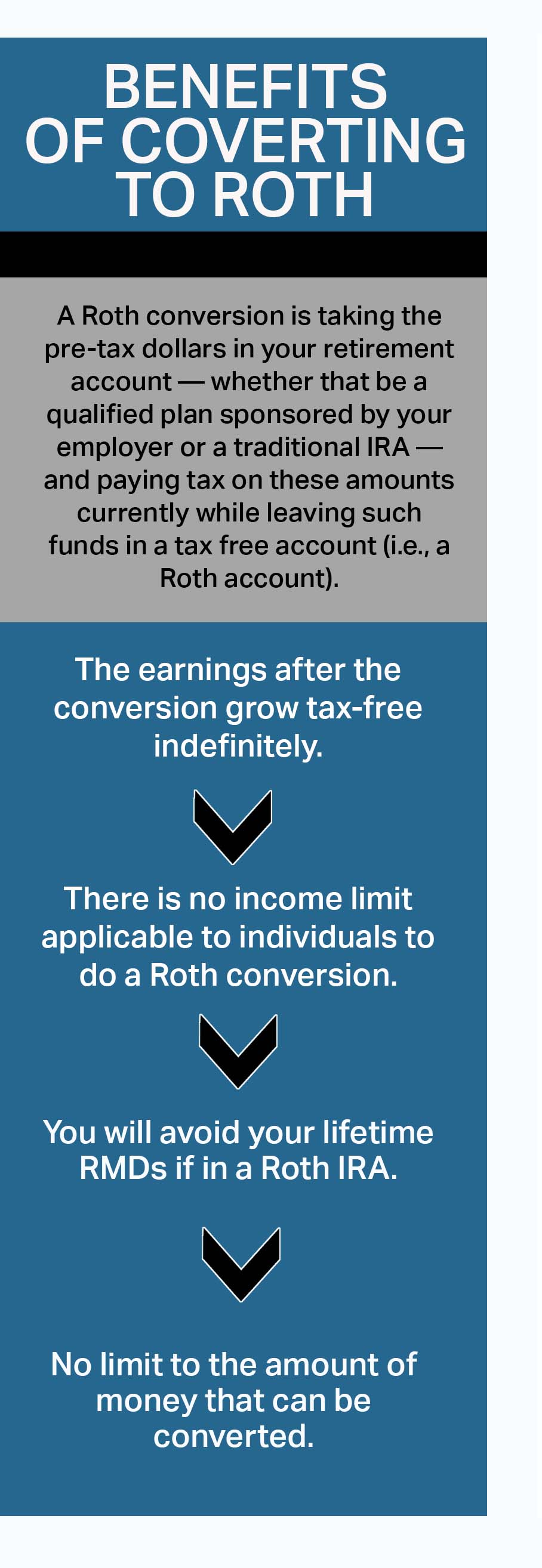

You can shift money from a traditional IRA or 401 k into a Roth IRA by doing a Roth IRA conversion. Converting a 401 k to a Roth IRA You can also convert traditional 401 k balances to a Roth IRA. The good news is that you can convert your traditional IRA to a Roth IRA or your traditional 401k to a Roth 401k.

The price to make that conversion is including the amount you convert to Roth as taxable income for the year in which you make the conversion. Converting 401k into a Roth IRA. Not every company allows employees to convert an existing 401 k balance to a Roth 401 k.

7 Converting to a Roth IRA Over Time. Money contributed to a Roth is after-tax while 401 k contributions are pretax. In part thats because nearly one-third of employers simply dont offer a Roth option.

The conversion is reported on Form 8606 PDF Nondeductible IRAs. All youll have to do is follow the same steps as if you were rolling over a traditional 401k to a traditional IRA. You can roll over from a traditional 401k into a traditional IRA tax-free.

You can convert a traditional IRA or a 401 k to a Roth IRA. A conversion to a Roth IRA results in taxation of any untaxed amounts in the traditional IRA. The transferred funds have the same tax basis.

If you want to move that money into a Roth IRA youll have to pay taxes on it. Potential Benefits Most workers still have the lions share of their retirement money tucked inside a traditional 401 k. Generally youll only be able to transfer a 401 k to a Roth IRA once youve left the company that provided the 401 k or once you reach the age of 59½ which is.

If youre looking to convert your Roth 401k into a traditional IRA youre out of luck. Technically a Roth conversion is also a rollover and occurs when a distribution is made from a traditional account under an eligible retirement plan. Most employer plans dont allow employees to transfer money from a 401 k account to an IRA while theyre still working but a few do offer what are.

However when you terminate employment you may convert and roll over your IRA at the same time. Traditional IRA rollover IRA SEP IRA and SIMPLE IRA after held for 2 years as well as assets in tax-qualified retirement plans such as 401 k 403 b 457 b profit sharing and money purchase plans. Roth 401 k to Roth IRA Conversions The rollover process is straightforward if you have a Roth 401 k and youre rolling it over into a Roth IRA.

1 The following account types are eligible for conversion to a Roth IRA. As a reminder you must generally be separated from your employer to roll your 401k into a Roth IRA.

Systematic Partial Roth Conversions Recharacterizations

Systematic Partial Roth Conversions Recharacterizations

How To Do A Backdoor Roth Ira Contribution Safely

How To Do A Backdoor Roth Ira Contribution Safely

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Mega Backdoor Roth Convert Within Plan Or Out To Roth Ira

Mega Backdoor Roth Convert Within Plan Or Out To Roth Ira

How To Access Retirement Funds Early

How To Rollover Your 401k To A Roth Ira Can You Transfer It

How To Rollover Your 401k To A Roth Ira Can You Transfer It

Roth Ira Conversion What To Know Before Converting Fidelity

Roth Ira Conversion What To Know Before Converting Fidelity

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year Myra Personal Finance For Immigrants

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year Myra Personal Finance For Immigrants

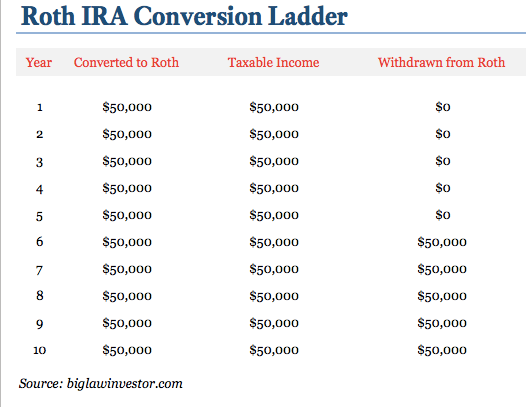

The Roth Ira Conversion Ladder Biglaw Investor

The Roth Ira Conversion Ladder Biglaw Investor

Should You Convert Retirement Account To A Roth Account During The Covid 19 Pandemic

Should You Convert Retirement Account To A Roth Account During The Covid 19 Pandemic

5 Times A Roth 401k Conversion Is A Good Idea Above The Canopy

Comments

Post a Comment