How Do You Buy Mutual Funds

Read carefully however as some funds do charge transaction fees for buying or selling even when purchased directly. Information you need to.

How To Sell Buy Mutual Funds Online Kotak Securities

How To Sell Buy Mutual Funds Online Kotak Securities

You buy mutual funds using an investment account.

How do you buy mutual funds. An SP 500 Index fund can help your portfolio gain broad exposure to those kinds of stocks with minimal due diligence. The details on these can be found in a mutual fund. 2 days agoIn this guide we take you through all the key aspects of mutual funds.

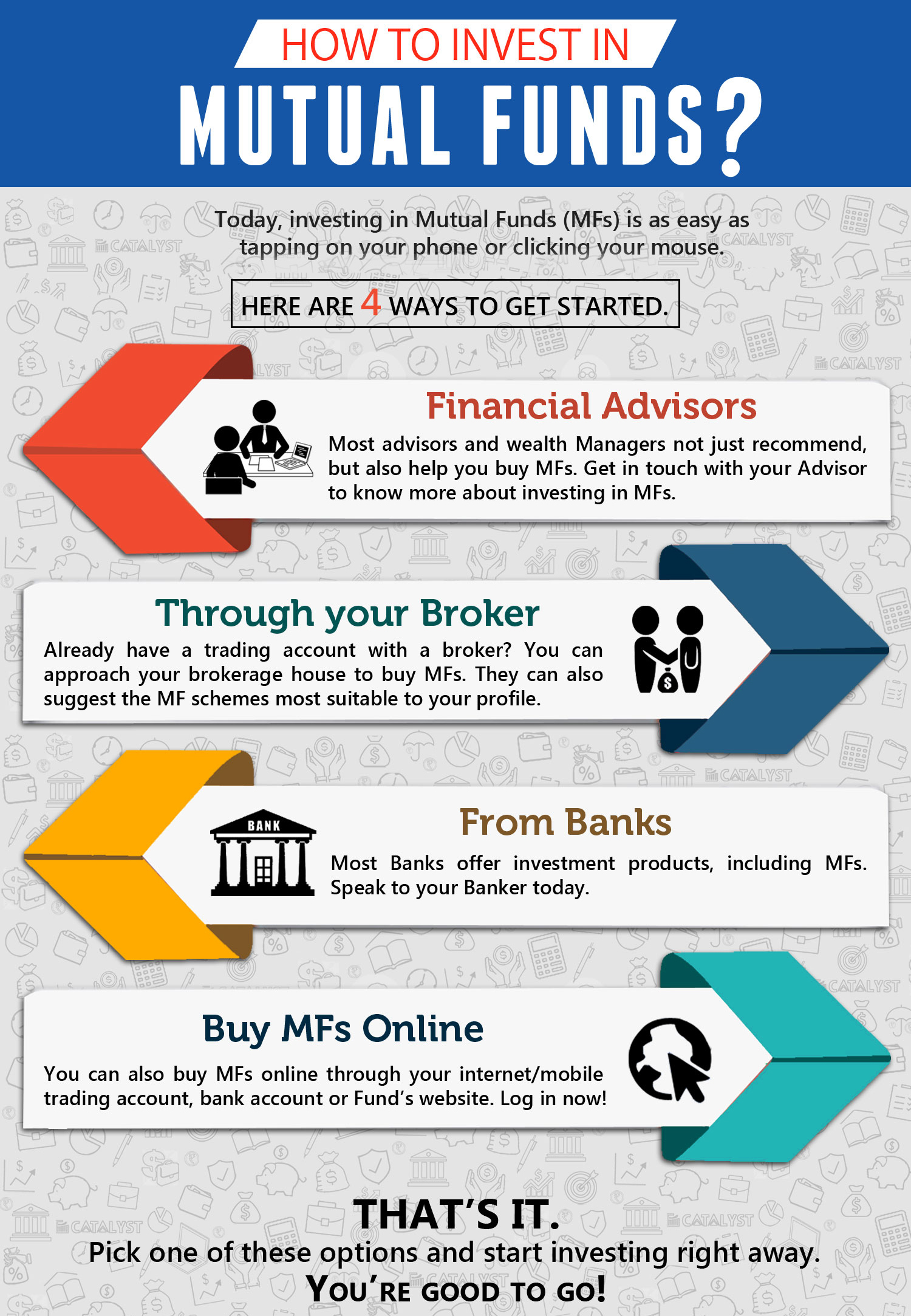

The easiest way to do it is through the brokers website. If you purchase a mutual fund directly through the management company for example a Vanguard fund from Vanguard or a Fidelity fund from Fidelity most funds dont have a trading fee. The most common method for determining a mutual funds price is to calculate or compare its NAV or Net Asset Value.

You also can buy. The fund then focuses on. Click on the green buy button and an order page will appear.

To start investing in mutual funds make sure you have enough money deposited in your investment account. Mutual fund rater Morningstar offers a great site to analyze funds and offers details on funds that include details on its asset allocation and mix. A mutual funds purchase price is determined by the previous days NAV.

Once you have found a mutual fund that youre confident in its time to make a purchase. A mutual fund is a type of investment product where the funds of many investors are pooled into an investment product. The most obvious option is to buy mutual funds directly through the investment companies that offer and manage them.

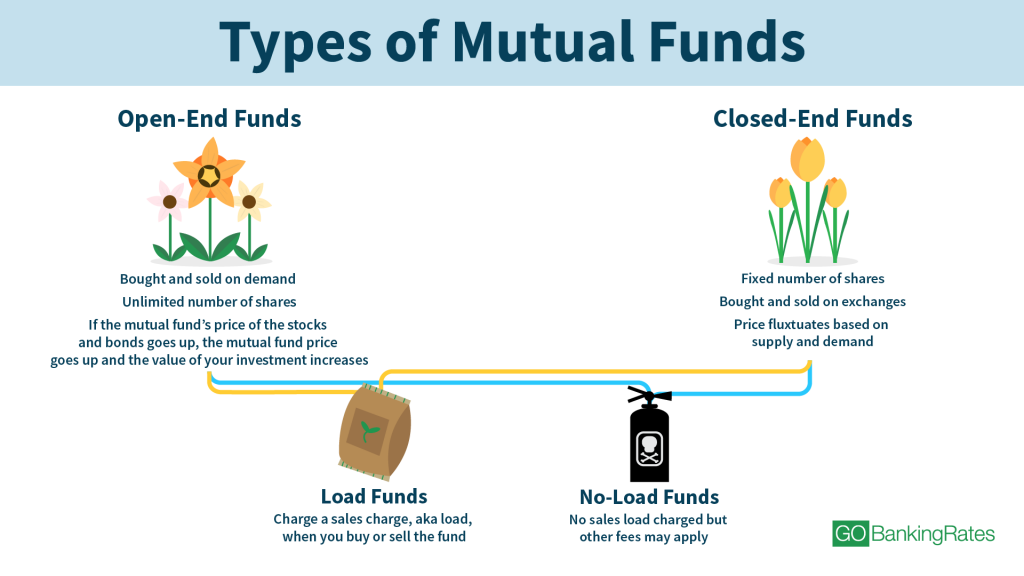

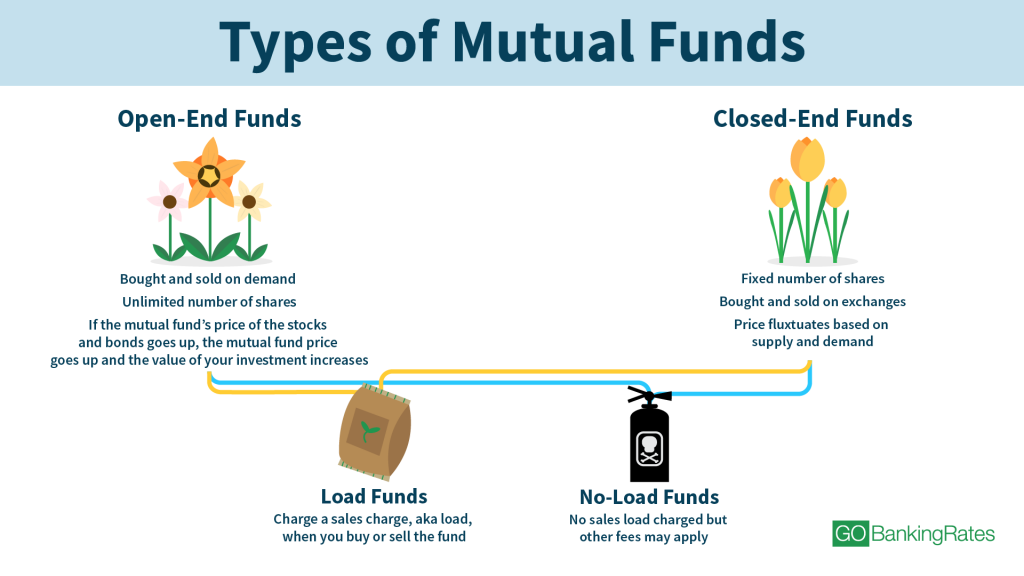

Fees associated with mutual funds do not vary across categories and typically include expense ratios and sales commission. Sales commissions and other one-time costs when you buy or sell mutual fund shares. If you are able to adhere to the simple rules of asset allocation use index funds automate finances where possible use only term insurance keep debt under control and you wont cross over 2 million in assets any time soon you can certainly manage your own finances.

If you contribute to an employer-sponsored retirement account such as a 401 k theres a good chance youre already invested in mutual funds. Through Your Broker If you have a brokerage account Roth IRA traditional IRA or another account with a stockbroker such as Charles Schwab or Merrill you can buy most mutual funds just like you would stocks. You might already do this through your workplace 401 k but you can also do so through an.

Mutual funds can be bought and sold directly from the company that manages them from an online discount broker or from a full-service broker. There are convenient green buy and red sell buttons at the top of a funds profile. On the order page the transaction fee if any will be displayed.

A mutual fund pools money from investors into an investment fund to buy assets also known as securities like stocks and bonds. Both index mutual funds and exchange-traded funds ETFs maintain a strategy. Keep in mind that mutual funds.

Tutorial How Do I Buy A Mutual Fund Vanguard Support

Tutorial How Do I Buy A Mutual Fund Vanguard Support

How To Sell Buy Mutual Funds Online Kotak Securities

How To Sell Buy Mutual Funds Online Kotak Securities

How To Buy A Mutual Fund At Fidelity With Screenshots The Wall Street Physician

How To Buy A Mutual Fund At Fidelity With Screenshots The Wall Street Physician

Understanding Mutual Funds Pros And Cons Gobankingrates

Understanding Mutual Funds Pros And Cons Gobankingrates

Tutorial How Do I Buy A Mutual Fund Vanguard Support

Tutorial How Do I Buy A Mutual Fund Vanguard Support

How To Invest In Mutual Funds Jamapunji

How To Invest In Mutual Funds Jamapunji

How To Buy Mutual Funds Forbes Advisor

How To Buy Mutual Funds Forbes Advisor

How To Buy Mutual Funds Online From Home How To Start Sip In Mutual Funds Investing In Mutual Fund Youtube

How To Buy Mutual Funds Online From Home How To Start Sip In Mutual Funds Investing In Mutual Fund Youtube

How To Invest In Mutual Funds The Investment Mania

Should You Buy Mutual Funds From Your Bank The Reformed Broker

What Are Mutual Funds Smart About Money

What Are Mutual Funds Smart About Money

How To Invest In Mutual Funds With Fidelity Youtube

How To Invest In Mutual Funds With Fidelity Youtube

Is It Wise To Invest In A Mutual Fund Quora

Comments

Post a Comment