How Much Child Tax Credit 2020

To be eligible to claim the child tax credit your child or dependent must first pass all. More than 48 million households are expected to claim the Child Tax Credit for 2020 according to the Joint Committee on Taxation of Congress.

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

For 2020 the Child Tax Credit begins to phase out decrease in value at an adjusted gross income of 200000 for Single or at 400000 for Married Filing Jointly.

How much child tax credit 2020. For 2020 the maximum amount of the credit is 2000 per qualifying child. 8 But the TCJA changed this limit tooin favor of wealthier families. For many it may provide a much-needed source of relief as part of a 2020 tax year refund.

The overall credit is reduced by 50 for every 1000 over the phase-out or limit until its eliminated entirely. However you may be able to claim a refundable Additional Child Tax Credit for the unused balance. For the period of July 2020 to June 2021 you could get up to 2886 24050 per month for each child who is eligible for the disability tax credit.

The maximum amount of the child tax credit per qualifying child that can be refunded even if the taxpayer owes no tax. Youll receive a credit worth 20 to 35 of these expenses depending on your income. The credit is worth up to 2000 per dependent for tax year 2020 but your income level determines exactly how much you can get.

This is up from the prior 1000 amounts. Child Tax Credit family element. The 2020 Child Tax Credit Amount With tax reform the Child Tax Credit was increased to 2000 per qualifying child and will be refundable up to 1400 subject to income phaseouts.

Up to 1400 per qualifying child is refundable with the Additional Child Tax Credit. Child Tax Credit 2020 If you have a small tax bill or dont owe any taxes at all you can receive up to 1400 of the Child Tax Credit as a refund as. You can find out if youre eligible for this refundable credit by completing the worksheet in IRS Form 8812.

This can include dependents over the age of 16 and dependents. The maximum amount of the credit for other dependents for each qualifying dependent who isnt eligible to be claimed for the child tax credit. 2020 to 2021 2019 to 2020.

The maximum amount of the child tax credit per qualifying child. If you qualify you can claim up to 3000 of care expenses for one dependent or 6000 for two or more dependents. Previously the child tax credit was a 2000 credit parents could claim on their taxes for every child.

Certain income limits will lower this credit amount. Table of Contents show. The child tax credit for 2020 2021 allows you to get back up to 2000 per child in taxes.

Go to Child disability benefit. How much is the Child and Dependent Care Credit worth in 2020. What it is and how much you can get For the 2020 tax year the Child and Dependent Care Credit can get you 20 to 35 of up to 3000 of child care and similar costs for a child under 13 an.

The Child Tax Credit is the credit that you get for having a dependent under the age of 17 explains Lisa Greene-Lewis CPA and tax expert for TurboTax adding that its worth 2000 per child. This tax credit has helps millions of families every year and has been proposed to be expanded with the Trump Tax Reform. There are two parts to the Child Care Tax Credit.

For each qualifying child age 5. It only applies to dependents who are younger than 17 as of the last day of the tax year. The Child Tax Credit is also subject to income limits for taxpayers who earn too much.

The Child Tax Credit CTC is designed to give an income boost to the parents or guardians of children and other dependents. Children with a disability If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit. Child tax credit qualifications and income limits Some people may be confused about how their payments will be divided between 2021 and 2022.

Calculate how much tax credit including working tax credits and child tax credits you could get every 4 weeks during this tax year 6 April 2020 to 5 April 2021. When figuring your income for the purposes of the Child Tax Credit you must include any foreign income exclusions. This is a tax credit which means it reduces your tax bill dollar-for-dollar which makes it highly valuable for all families.

And previously the Child Tax Credit was only refundable if you filed for the Additional Child Tax Credit. Previously you needed at least 2500 to.

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What Is The Child Tax Credit Tax Policy Center

What Is The Child Tax Credit Tax Policy Center

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What Is The Child Tax Credit And How Much Of It Is Refundable

What Is The Child Tax Credit And How Much Of It Is Refundable

Donate To Arizona Tax Credit To Help Children Receive

Donate To Arizona Tax Credit To Help Children Receive

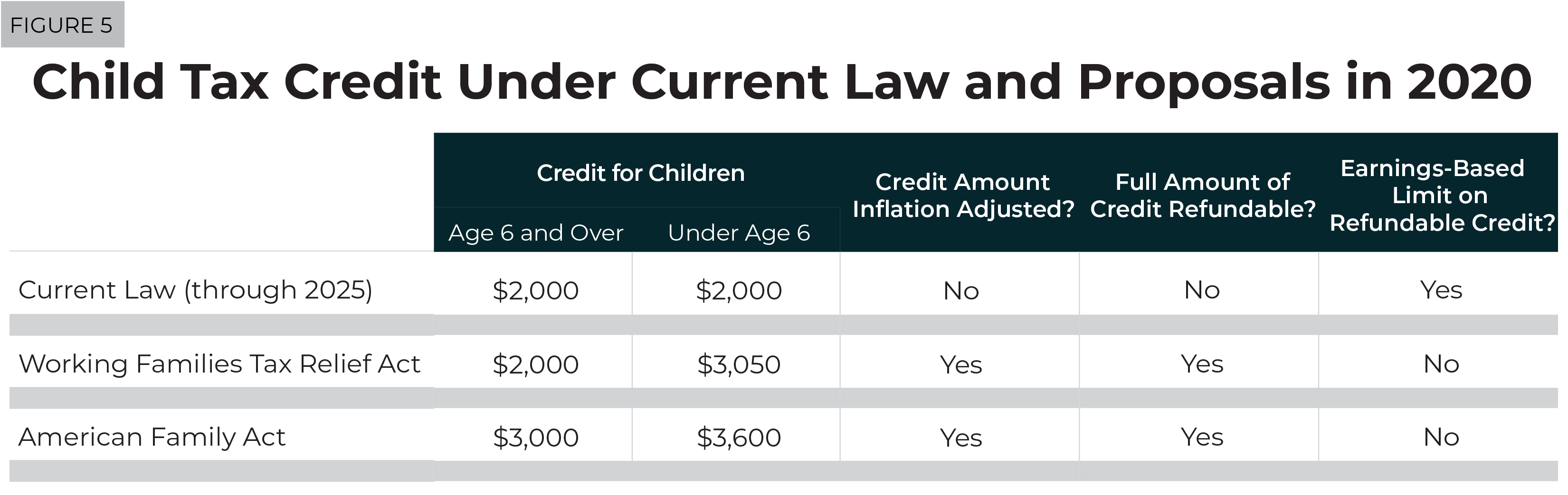

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

Expanding The Child Tax Credit Full Refundability And Larger Credit Tax Policy Center

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

New Itep Estimates On Biden S Proposal To Expand The Child Tax Credit Itep

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

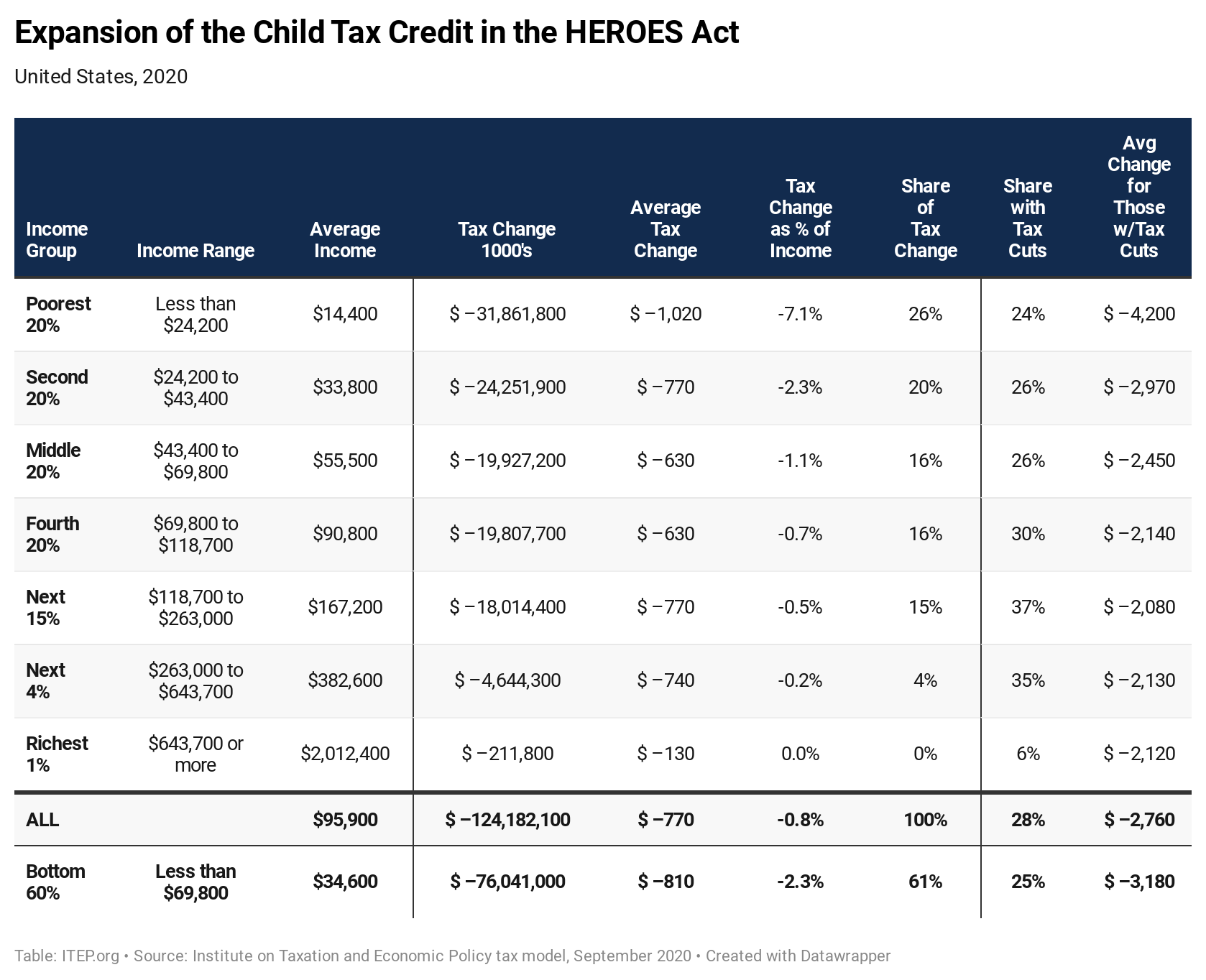

Understanding Five Major Federal Tax Credit Proposals Itep

Understanding Five Major Federal Tax Credit Proposals Itep

The Child Tax Credit Ctc A Primer Tax Foundation

The Child Tax Credit Ctc A Primer Tax Foundation

Child Tax Credit By Agi Ff 09 28 2020 Tax Policy Center

Child Tax Credit By Agi Ff 09 28 2020 Tax Policy Center

Maximizing The Child Tax Credit Even Without Earned Income Go Curry Cracker

Maximizing The Child Tax Credit Even Without Earned Income Go Curry Cracker

Comments

Post a Comment