Track Federal Tax Return

A customer service representative will advise you of your expected refund date your balance due amount or any changes made to your return. If accepted by the IRS use the federal tax refund website to check the refund status - httpswwwirsgovrefunds.

Your Social Security number or Individual Taxpayer Identification Number filing status -- single married or head of.

Track federal tax return. How to Track an Income Tax Return Step 1 Call the IRS customer service line at 1-800-829-1040 and request a status update. Your federal tax refund isnt taxable so this category shouldnt be linked to any tax schedule or even marked as tax related. - One of IRSs most popular online features-gives you information about your federal income tax refund.

Check your refund status by phone Before you call. If you do not have a copy of your 2019 tax return you may use the IRS Get Transcript self-help tools to get a tax return transcript showing your AGI. When these are filled in Quicken flags the category as one that raises or lowers your taxes.

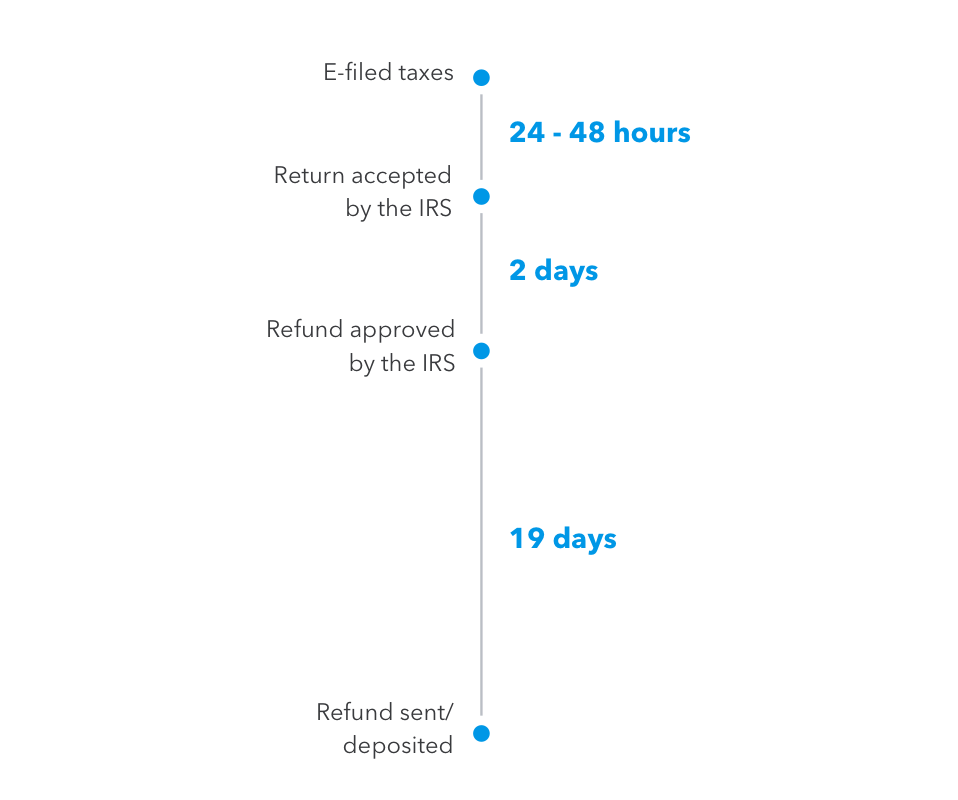

IRS tax refund tracker. Tracking your Tax Refund Online 1 Wait for 24 hours after you e-file your tax return. Track your tax refund by phone by calling the IRS Refund Hotline at 800-829-1954 or the Tele Tax System at 800-829-4477.

If your return was accepted more than 21 days ago but you. Once youve filed your federal income tax return you can use the Wheres My Refund tool on the IRS website to track any refund you may be owed. Wheres My Refund has a tracker that displays progress through three stages.

You have two options. You get personalized refund information based. How do I track my 2019 federal tax return.

If you are still waiting to file your tax return make sure the procrastination doesnt stretch too much longer. Once a tax return has been Accepted by the IRS or a State TurboTax receives no further information concerning the tax return or the status of any tax refund. Track your federal tax refund.

Step 2 Track an amended tax return filed. To verify your identify youll need. The tool tracks your refunds progress through 3 stages.

Amending your return might be necessary to calculate the correct amount of taxes owed or the refund thats due to you. If you e-filed you can start checking as soon as 24 hours after the IRS accepts your e-filed return. You need several things on hand to track the status of your tax refund.

You need several things on hand to track the status of your tax refund. Your Social Security number or Individual Taxpayer Identification Number filing status -- single married or head of. You must successfully submit your tax return to be able to track it.

Line 150 from your most recent assessment. Refunds Internal Revenue Service. You can still track the refunds status through the IRS website if you file an amended return.

Just plug in your Social Security number your date of birth and your zip code. Which tax year are you filing for. Call it Fed Tax Refund.

Full name and date of birth. Wheres My Refund can be checked within 24 hours after the IRS has received an e-filed return or four weeks after receipt of a mailed paper return. COVID-19 Mail Processing Delays Its taking us longer to process mailed documents including.

If you have already filed your federal tax return though you can track the status of a refund if you are due to receive one online. How can I track a federal tax refund. Always open automated line No wait times.

When you set up this category leave the Tax-related check box cleared and the Tax line item field empty. Taxpayers can start checking on the status of their return within 24 hours after the IRS received their e-filed return or four weeks after they mail a paper return. The IRS receives the tax return then approves the refund and sends the refund.

1 Return Received 2 Refund Approved and 3 Refund Sent. Get information about tax refunds and updates on the status of your e-file or paper tax return. 3 ways to track your return status in 2020 If you file your federal taxes online you can start checking your refund status in 24 hours.

Includes a tracker that displays progress through three stages. If you send your return by mail you will have to wait about 4 weeks until you are able to track your. Track The Status of Your Federal Tax Return Online.

Track My Refund Nolens Accounting And Tax Service

Track My Refund Nolens Accounting And Tax Service

Where S My Refund Tax Refund Tracking Guide From Turbotax

Where S My Refund Tax Refund Tracking Guide From Turbotax

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Tax Return Copy Can Be Downloaded Form Efile Com Order

Tax Return Copy Can Be Downloaded Form Efile Com Order

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Contact The Irs If You Haven T Received Your Refund

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

/Balance_Tax_Refund_Status_Online_1290006_V1-a947aed0306642faac9f0e1029d9ef6c.png) Trace Your Tax Refund Status Online With Irs Gov

Trace Your Tax Refund Status Online With Irs Gov

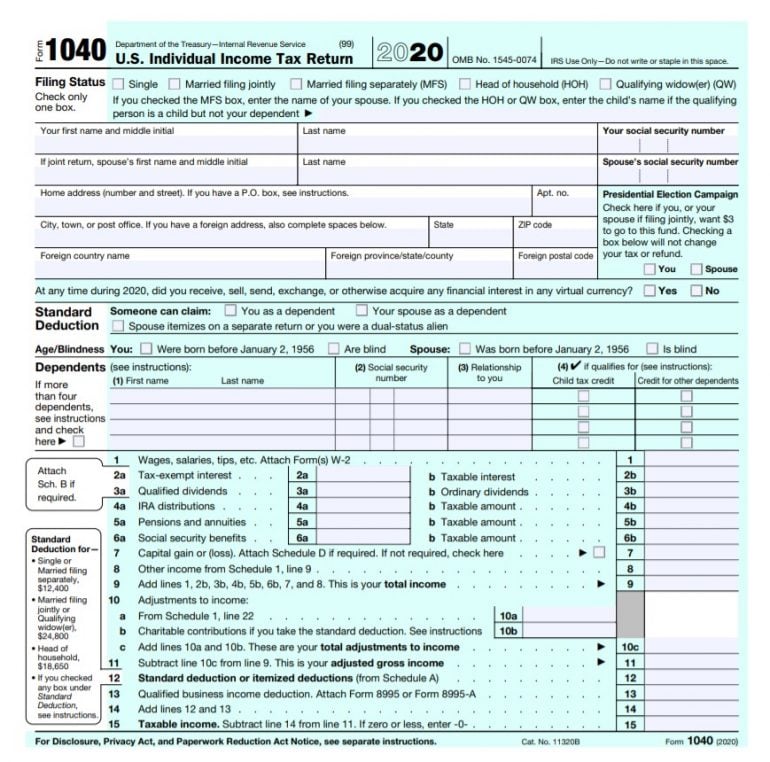

Irs Form 1040 Individual Income Tax Return 2021 Nerdwallet

Irs Form 1040 Individual Income Tax Return 2021 Nerdwallet

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Refunds Internal Revenue Service

Refunds Internal Revenue Service

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

When Will I Get My 2020 Tax Refund Possible Dates And How To Track Your Money

When Will I Get My 2020 Tax Refund Possible Dates And How To Track Your Money

Comments

Post a Comment