2019 Tax Return Still Processing

Your return has been flagged for identity theft or fraud. If you file electronically the IRS can take up to three days to accept your return.

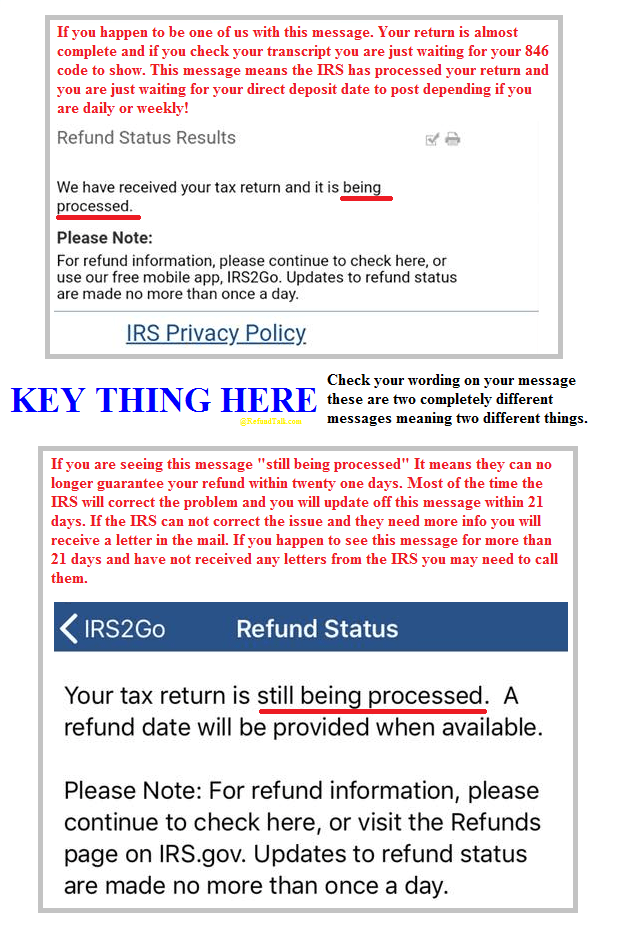

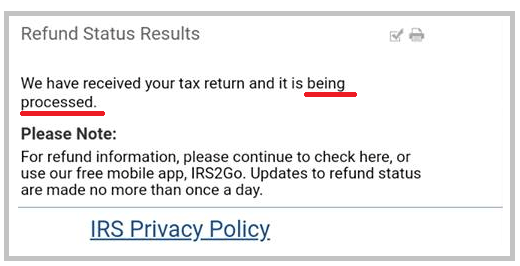

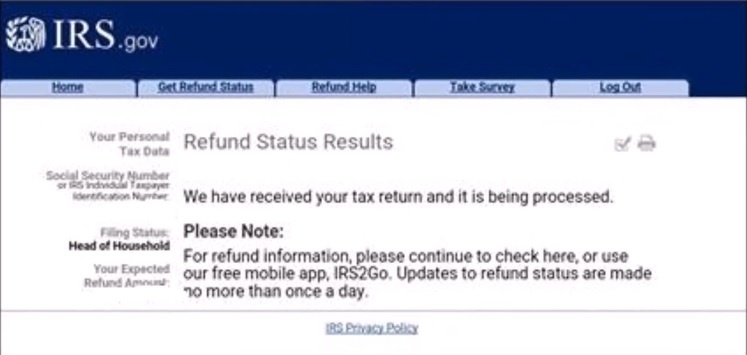

Irs Still Being Processed Vs Being Processed Refundtalk Com

Irs Still Being Processed Vs Being Processed Refundtalk Com

If you submit your tax return by mail the IRS says it could take six to eight weeks for your tax refund to arrive.

2019 tax return still processing. If any social security number on your return has already been submitted for a particular. Reaching out because I have been unable to contact the IRS. While the IRS extended the deadline for Texans to file their 2020 federal income taxes due to the winter storm some North Texans are still waiting for the agency to process their 2019 returns.

Its almost certainly sitting in a bin with thousands of other amended returns but the IRS Automated Underreporting Unit discovered the error and sent the clients a notice. My 2019 tax return is still being processed and it has been over a month since I e-filed it. The agencys website states there were 71 million unprocessed individual tax returns as of November 24 2020.

If your tax return status has been showing that same message for multiple weeks that means the IRS is reviewing some aspect could be anything of your tax return. The amended return still has not been processed and no one knows when it will be. But you dont have to check multiple times a day.

WBZ TVs Breana Pitts reports. Millions of tax refunds delayed 0711. On top of this tax seasons challenges the IRS is also dealing with a backlog of 2019 paper tax returns that it was unable to process after closing its offices during the height of the pandemic according to the Taxpayer Advocate Service.

The pandemic has caused significant delays particularly for returns filed on paper like Keiths. As of January 29 that is about two weeks before this years tax season opened Feb. If you mail in your return it can take three additional weeks the IRS has to manually enter your return into the system first.

If it was filed in early 2020 as it normally would have so you have been waiting a year or more for your refund you could print it out sign it and mail it back in as it must have gotten lost in the system somehow. The IRS is sitting on a massive backlog of mailed-in 2019 tax returns and some households have been waiting months for their refund. Check the status of your refund by using the Wheres My Refund tool at irsgovrefunds or by calling 800-829-1954.

How Long It Takes the IRS to Process a Tax Refund. Typically the IRS issues a refund within 21 days of accepting a tax return. Body Of Missing Swimmer Found Off Crane Beach In Ipswich But hes got something else working against him.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. The refund portal is only updated once a day usually overnight. Fortunately I was able to get in contact with an IRS worker last Wednesday at which time they confirmed that my check for owed tax amount had been deposited by the IRS on April 19th 2020.

This could mean that all of the necessary forms were not sent to the IRS for processing. No the still processing message does not have anything to do with paying your TurboTax fees with your refund. Your tax return included errors.

Why is it taking so long to get tax refunds this yearSome are taking the IRS 6-8 weeks in 2021. Of the nearly 30 million returns being held for manual processing more than 8 million individual. They found the same error.

Your tax return is incomplete. Writersrescue You did not mention when the 2019 tax return was filed. Although that seems perfectly logical I am almost certain that is not the reason.

12 the agency had yet to process 76 million prior-year returns. There are many different reasons why your refund may have not been processed yet but the most common include. The IRS is holding 29 million tax returns for manual processing delaying tax refunds for many Americans according to the.

You should count another week into your time estimate if you. The Internal Revenue Service said in mid-February that it had yet to process 67 million individual income tax returns for 2019 based on data through Jan. As stated in the title my 2019 tax return is still processing according to the IRS website.

Here are some possible dates. Thats where tracking your refund comes in handy.

Irs Still Processing Almost 7 Million 2019 Tax Year Returns Don T Mess With Taxes

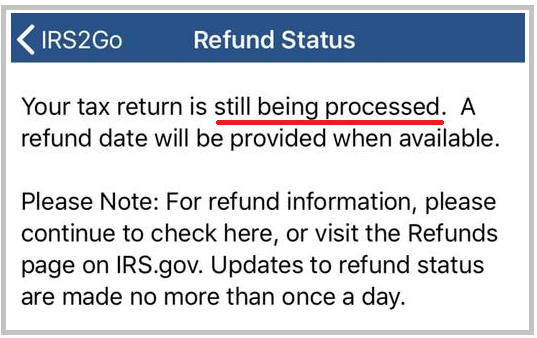

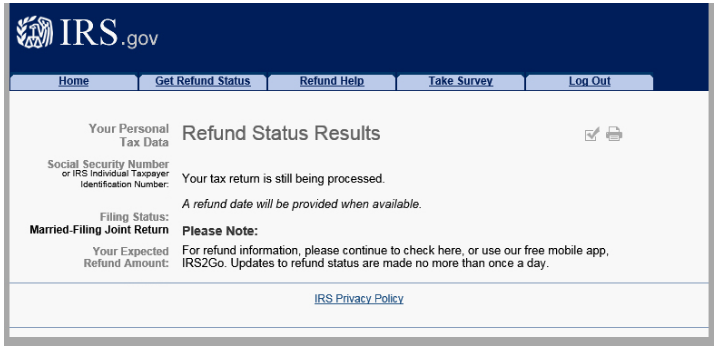

Your Tax Return Is Still Being Processed Refund Date Will Be Provided When Available Refundtalk Com

Your Tax Return Is Still Being Processed Refund Date Will Be Provided When Available Refundtalk Com

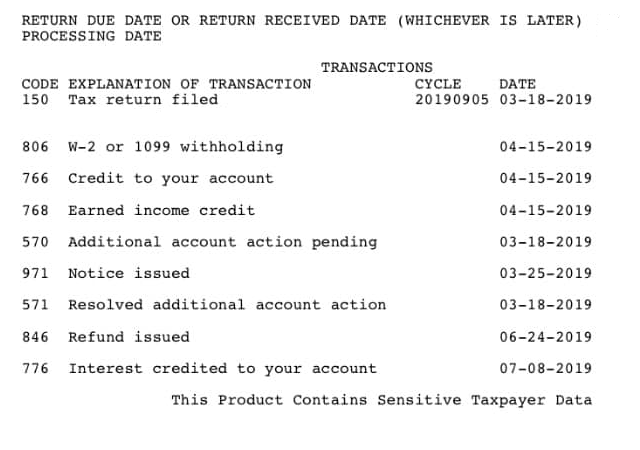

Will Ordering An Irs Tax Transcript Help Me Find Out When I Ll Get My Refund Or Stimulus Check Aving To Invest

Will Ordering An Irs Tax Transcript Help Me Find Out When I Ll Get My Refund Or Stimulus Check Aving To Invest

Irs Still Being Processed Vs Being Processed Refundtalk Com

Irs Still Being Processed Vs Being Processed Refundtalk Com

Why Do Where S My Refund Bars Disappear Youtube

Why Do Where S My Refund Bars Disappear Youtube

Common Irs Where S My Refund Questions And Errors

Common Irs Where S My Refund Questions And Errors

Your Tax Return Is Still Being Processed Amy Northard Cpa The Accountant For Creatives

Your Tax Return Is Still Being Processed Amy Northard Cpa The Accountant For Creatives

Wmr And Irs2go Status Differences Return Received Accepted Or Under Review And Refund Approved Versus Refund Sent Aving To Invest

Wmr And Irs2go Status Differences Return Received Accepted Or Under Review And Refund Approved Versus Refund Sent Aving To Invest

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Expect Long Delays In Getting Refunds If You File A Paper Tax Return Tax Policy Center

Your Tax Return Is Still Being Processed Refund Date Will Be Provided When Available Refundtalk Com

Your Tax Return Is Still Being Processed Refund Date Will Be Provided When Available Refundtalk Com

I Got My 2019 Tax Refund Already Youtube

I Got My 2019 Tax Refund Already Youtube

Your Tax Return Is Still Being Processed Refund Date Will Be Provided When Available Refundtalk Com

Your Tax Return Is Still Being Processed Refund Date Will Be Provided When Available Refundtalk Com

Comments

Post a Comment