Typical House Closing Costs

Closing costs typically range from 3 to 6 of the homes purchase price. If the value of your property is higher the land transfer tax could cost more than 10000.

How To Estimate Closing Costs Assurance Financial

How To Estimate Closing Costs Assurance Financial

Though closing costs vary depending on the loan amount mortgage type and the area of the country where youre buying or refinancing.

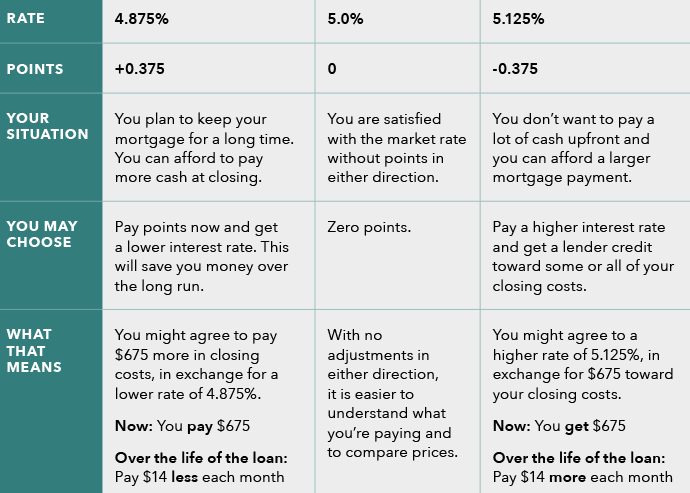

Typical house closing costs. To get a more accurate estimate you can use your homes actual listing price. 1 Much depends on the points and origination fees a lender charges to make the loan. Typically home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees.

In 2019 the most recent data available the average closing costs for a single-family home were 5750. Below is a list of the most common closing cost description and approximate costs. 52 Zeilen The average closing costs in the United States total 5749 including taxes.

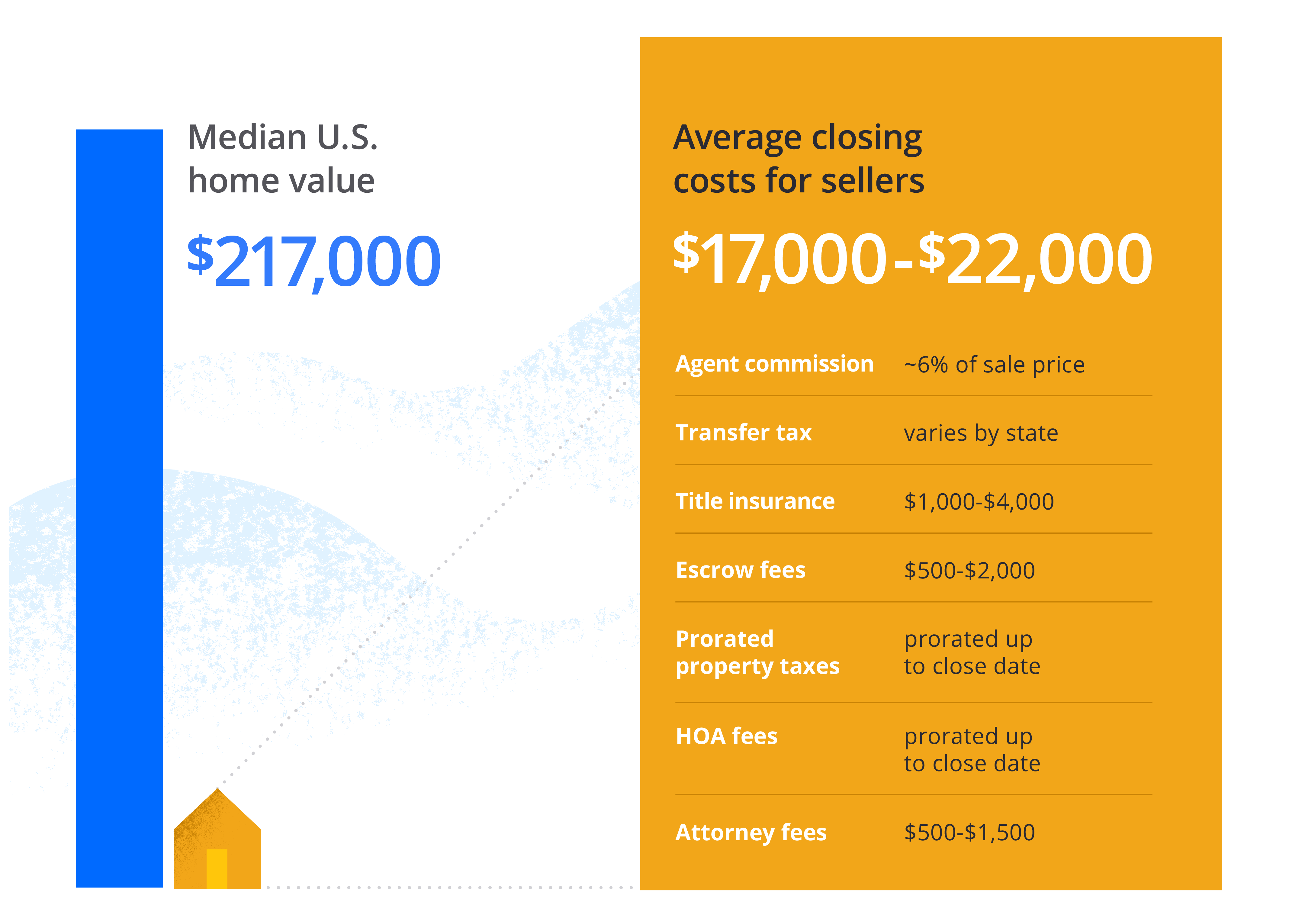

The buyer must send 531556 plus the remaining purchase price balance after Credit of 1697500 170281546. Closing costs for sellers of real estate vary according to where you live but as the seller you can expect to pay anywhere from 6 to 10 of the homes sales price in closing costs at settlement. So if your home cost 150000 you might pay between 3000 and 7500 in closing costs.

Using this number its easy to get an estimation of closings costs. Closing costs are the expenses that you pay when you close on the purchase of a home or other property. Its good to note however that even though you may avoid the bulk of closing costs you as the seller will still have to cover.

You can expect to pay between 5468 and 13670 cumulatively on closing costs. The median sale price of Pennsylvania homes is 200367. The average closing costs required to buy a home in the US were 6087 including taxes and 3470 excluding taxes in 2020 according to data from mortgage technology company ClosingCorp.

Most Pennsylvania home sellers can expect to pay around 2004- 6011 in closing costs. Closing costs are typically about 3-5 of your loan amount and are usually paid at closing. Todays average closing costs are likely higher as.

Total Cost To Buyer. What is included in closing costs. A majority of these costs go to the mortgage loan lender.

Land transfer taxalong with lawyer and legal feeswill make up the majority of the costs in closing while other costs can be expected to be much smaller. How much are closing costs. While closing costs can be expensive one of the largest mortgage expenses is the interest rate.

Appraisal fee Application fee Origination fee Title insurance policy for the lender Inspection fee Flood certification fee in some areas Prepaid interest. This document is called a loan estimate as of 2020. Over the life of the loan a few small percentage points can result in hundreds of thousands of.

Closing costs to buy a home typically run from about 2 to 7 of the purchase price with an average of around 3. We suggest preparing for. 1 Thus if you buy a 200000 house your closing costs could range from 6000 to.

The best guess most financial advisors and websites will give you is that closing costs are typically between 2 and 5 of the home value. These costs include application fees attorneys fees and discount points if applicable. Both buyers and sellers pay closing costs but its not an even split.

True enough but even on a 150000 house that means closing costs could be anywhere between 3000 and 7500 thats a huge range. Closing costs also known as settlement costs are the fees you pay when obtaining your loan. Typically the seller will pay between 5 to 10 of the sales price and the buyer will pay between 3 to 4 in closing costs.

In general closing costs average 1-5 of the loan amount. On average buyers pay roughly 3700 in. According to CostCorp the average cost to buyers at closing is 5749 including taxes.

Points and origination fees used to be disclosed on the buyers Good Faith Estimate. What Are Typical Closing Costs. Buyers have their own set of closing costs when buying a new home and they typically include.

The buyer closing cost of 531556 equals 03 the cost of the home 1750000 which is not bad. Everyones situation is different. While each loan situation is different most closing costs typically fall into four categories.

In general buyers pay around 2-5 of the home sale price in closing costs.

Prepaid Items Vs Closing Costs What S The Difference

Prepaid Items Vs Closing Costs What S The Difference

Closing Costs When Paying Cash For A Property Financial Samurai

Closing Costs When Paying Cash For A Property Financial Samurai

How Home Buyers Can Lower Closing Costs Wsj

How Home Buyers Can Lower Closing Costs Wsj

How Much Does It Cost To Sell A House Zillow

How Much Does It Cost To Sell A House Zillow

Home Buyers Closing Cost Calculator Mls Mortgage

Home Buyers Closing Cost Calculator Mls Mortgage

What Are Typical Real Estate Closing Costs

How Much Are Closing Costs For The Seller Opendoor

How Much Are Closing Costs For The Seller Opendoor

Closing Costs Am I Paying Too Much

Closing Costs Am I Paying Too Much

How To Calculate Closing Costs On A Home Real Estate

How To Calculate Closing Costs On A Home Real Estate

3 Ways To Estimate Closing Costs When Buying A House

Mortgage Closing Costs Explained In Detail Carolina Home Mortgage

Closing Costs Explained Home Closing 101

Closing Costs Explained Home Closing 101

Understanding Mortgage Closing Costs Lendingtree

Understanding Mortgage Closing Costs Lendingtree

Comments

Post a Comment