What Is A Revolving Credit Account

A revolving account is a type of credit account which provides a borrower with a maximum limit and allows for varying credit availability. These types of accounts provide more flexibility with an open line of credit up to a credit cap.

What Is A Revolving Credit With Pictures

What Is A Revolving Credit With Pictures

A revolving credit account lets borrowers access capital up to a maximum limit.

What is a revolving credit account. Revolving credit is an agreement that permits an account holder to borrow money repeatedly up to a set dollar limit while repaying a portion of the current balance due in. Revolving credit accounts let consumers repeatedly borrow capital up to a certain limit. With credit cards they are a personal line of credit and home equity lines of credit are pretty well known for this as well.

This type of credit account or line of credit also has a predetermined. You can choose either to pay off the balance in full at the end of each billing cycle or to carry over a balance from one month to the next or revolve the balance. Revolving credit accounts usually come with assigned credit limits and are subject to finance charges and fees.

When you apply for the account the creditor will likely review your credit history typically resulting in a hard. Credit cards are an example of revolving credit used by consumers. When you apply for the account the creditor will likely review your credit history typically resulting in a hard.

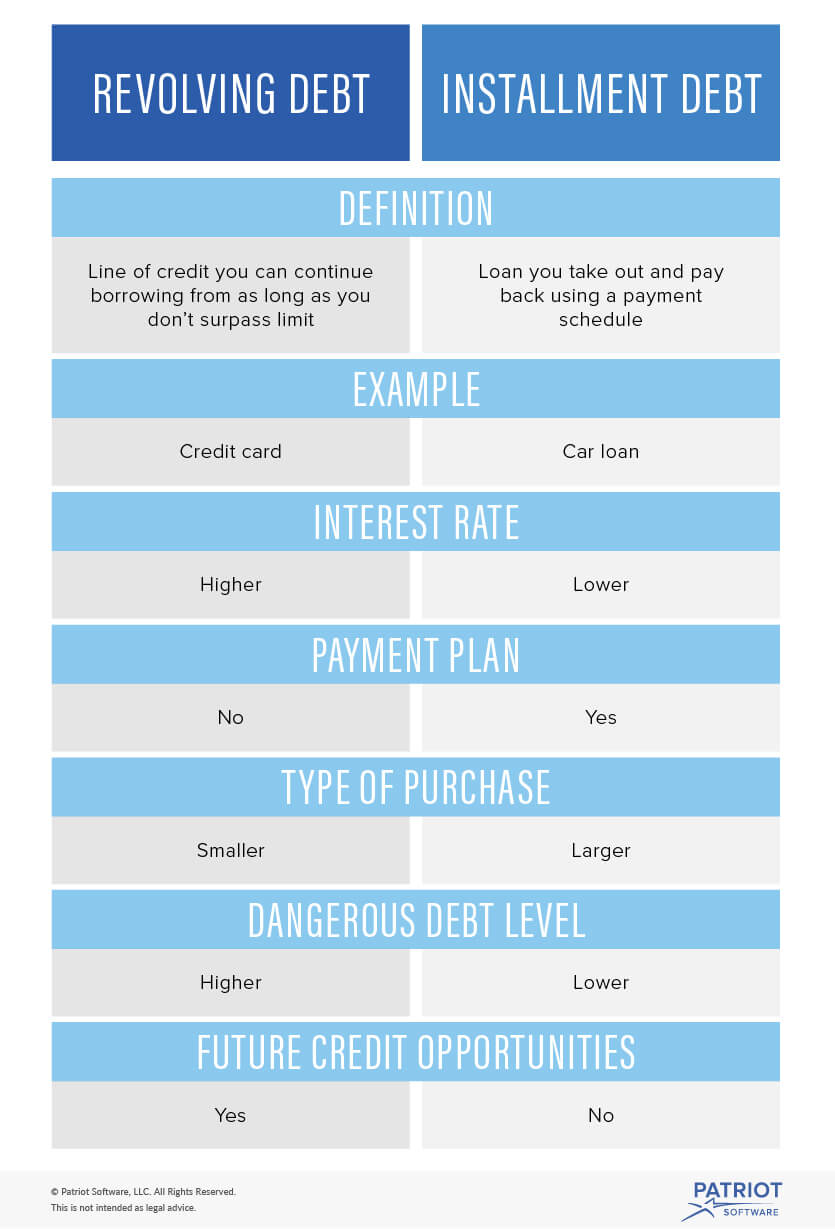

How can revolving accounts impact your credit. Revolving lines are usually credit cards or home equity lines while non-revolving are often car loans or mortgages. Credit cards personal lines of credit and home equity lines of credit are popular forms of revolving credit products though each has different features and is used for different purposes.

These are also structured differently from installment loans such as mortgages student. Key Takeaways A revolving account provides a credit limit to borrow against. Opening a new account may also lower your average age of accounts which might lower your scores.

Revolving credit items all come with different perks and can be used for different reasons. Revolving credit is a credit line you can borrow against and repay over and over again. A revolving credit account will enable people to borrow multiple times to a capital up to a specific amount.

A revolving credit account sets a credit limita maximum amount you can spend on that account. Revolving credit is a type of credit that can be used repeatedly up to a certain limit as long as the account is open and payments are made on time. A revolving credit account lets borrowers access capital up to a maximum limit.

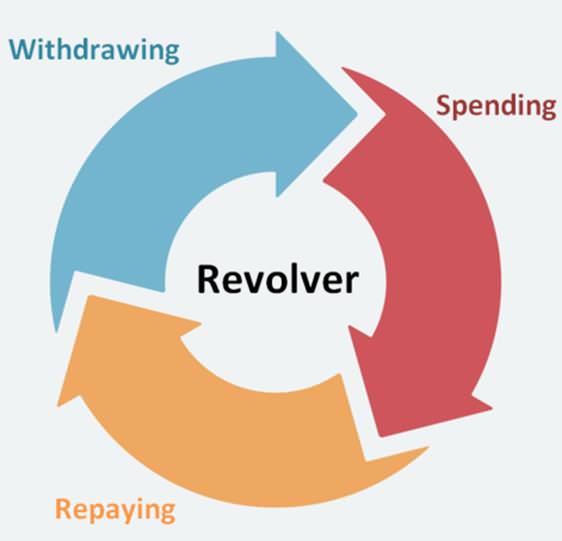

With revolving credit the amount of available credit the balance and the minimum payment can go up and down depending on the purchases and payments made to the account. A revolving credit account allows you to borrow money against a line of credit and pay it back over time with monthly payments which is often calculated as a percentage of your balance. Revolving credit is a type of credit that does not have a fixed number of payments or withdrawals.

Test your credit knowledge how well do you know what a revolving credit account is. People can withdraw the available funds and choose to either repay the. Revolving credit is a type of credit that does not have a fixed number of payments in contrast to installment credit.

Unlike a loan a revolving account doesnt automatically close when the account reaches a zero balance. What Is Revolving Credit. Corporate revolving credit facilities are typically used to provide liquidity for a companys day-to-day operations.

It gives you access to a set amount of money usually determined by your lender that you can access until youve borrowed up the maximum amount. You could also be. It can be a flexible way to borrow but its not ideal for every purchase.

Revolving credit is a type of credit in which the consumers balance and minimum monthly payment can fluctuate and where the cardholder usually has the option of avoiding finance charges by paying the last statement balance within the established grace period. You could also be. People can withdraw all or some of the available funds and choose to either repay the principal in its entirety or carry a balance to the next period.

What Is a Revolving Account. How can revolving accounts impact your credit. Learn how revolving credit works.

Opening a new account may also lower your average age of accounts which might lower your scores. There are actually two main types so if youre thinking of two terms. Minimum payments are usually due each month but the amount depends on the terms of the loan agreement.

What Is Revolving Credit And How It Works Paisabazaar Com 29 April 2021

What Is Revolving Credit And How It Works Paisabazaar Com 29 April 2021

The Three Types Of Credit Accounts You Should Be Familiar With

The Three Types Of Credit Accounts You Should Be Familiar With

Revolving Credit Facilities Key Differences How It Works Examples Youtube

Revolving Credit Facilities Key Differences How It Works Examples Youtube

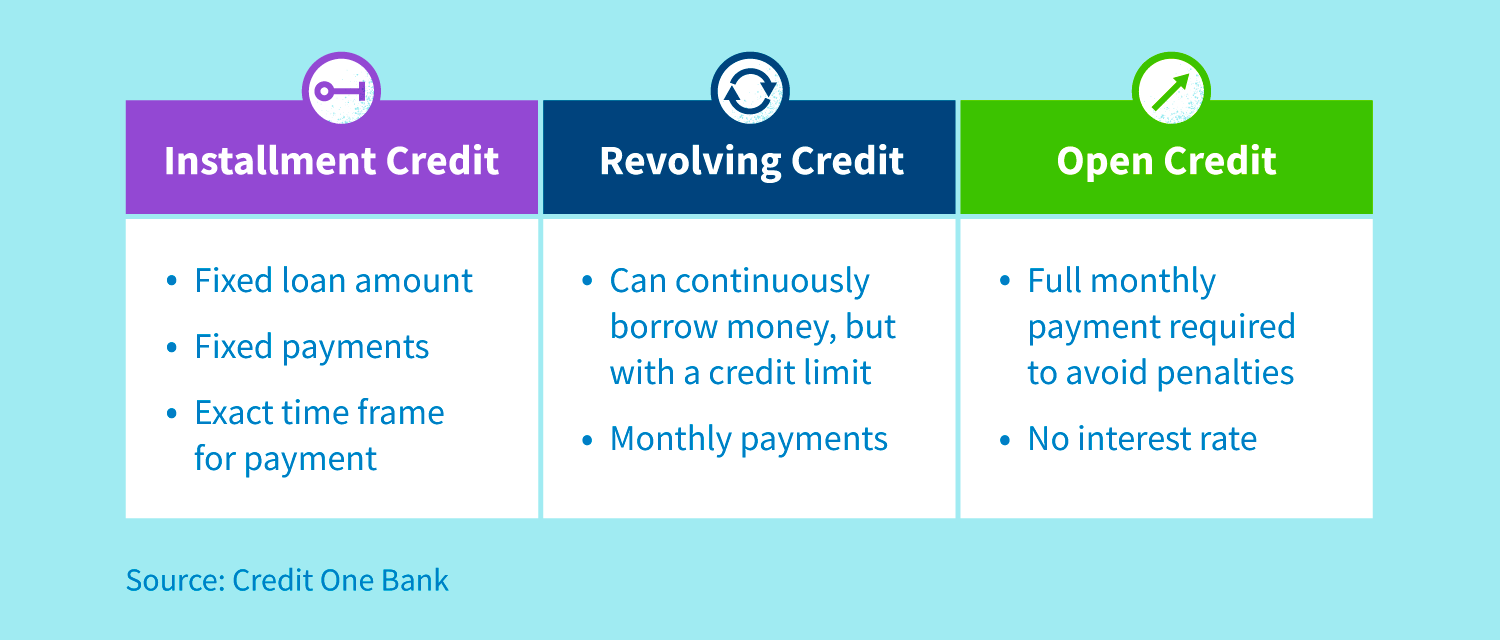

Three Main Types Of Credit Creditrepair Com

Three Main Types Of Credit Creditrepair Com

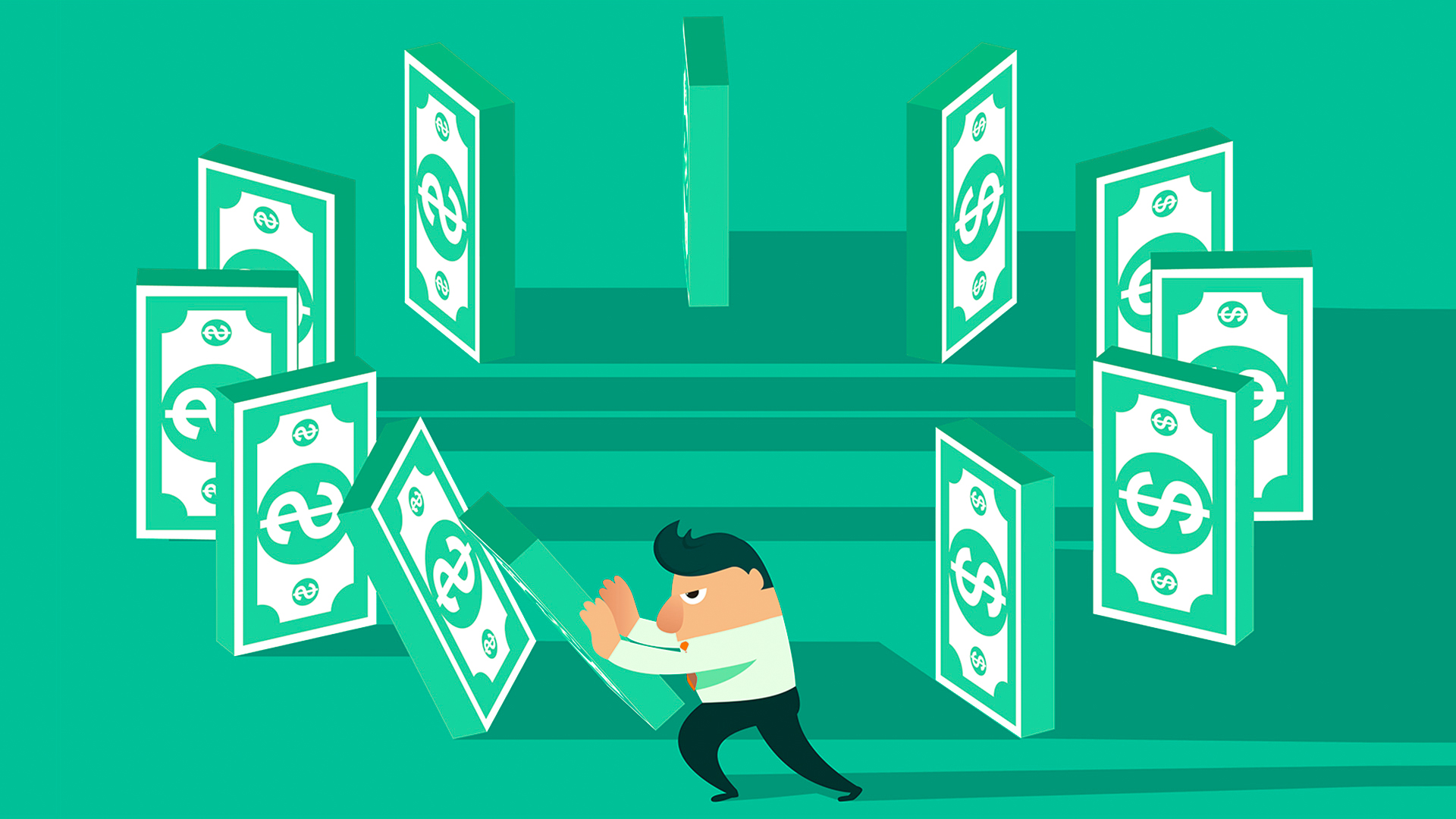

How To Manage Debt Using Revolving And Installment Credit Accounts

How To Manage Debt Using Revolving And Installment Credit Accounts

What Is A Revolving Credit Account Gobankingrates

What Is A Revolving Credit Account Gobankingrates

How A Revolving Credit Account Works

How A Revolving Credit Account Works

Revolving Credit Facility Guide To How A Revolver Woks

Revolving Credit Facility Guide To How A Revolver Woks

How Revolving Lines Of Credit Work Cash2u Loans

What Is A Revolving Credit Account

What Is A Revolving Credit Account

How Revolving Credit Works Howstuffworks

How Revolving Credit Works Howstuffworks

:max_bytes(150000):strip_icc()/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png) Revolving Vs Non Revolving Credit

Revolving Vs Non Revolving Credit

Revolving Credit Vs Line Of Credit What S The Difference

Revolving Credit Vs Line Of Credit What S The Difference

Revolving Debt Vs Installment Debt What S The Difference

Revolving Debt Vs Installment Debt What S The Difference

Comments

Post a Comment