How To Obtain An Ein Number

International applicants may call 267-941-1099 not a toll-free number 6 am. You may apply for an EIN in various ways and now you may apply online.

How To Apply For An Employer Tax Identification Number Ein Start Your Small Business Today

How To Apply For An Employer Tax Identification Number Ein Start Your Small Business Today

You may also apply by telephone if your organization was formed outside the US.

How to obtain an ein number. Generally businesses need an EIN. The EIN is listed with the title IRS. Most people prefer to obtain an EIN online because it is fairly easy.

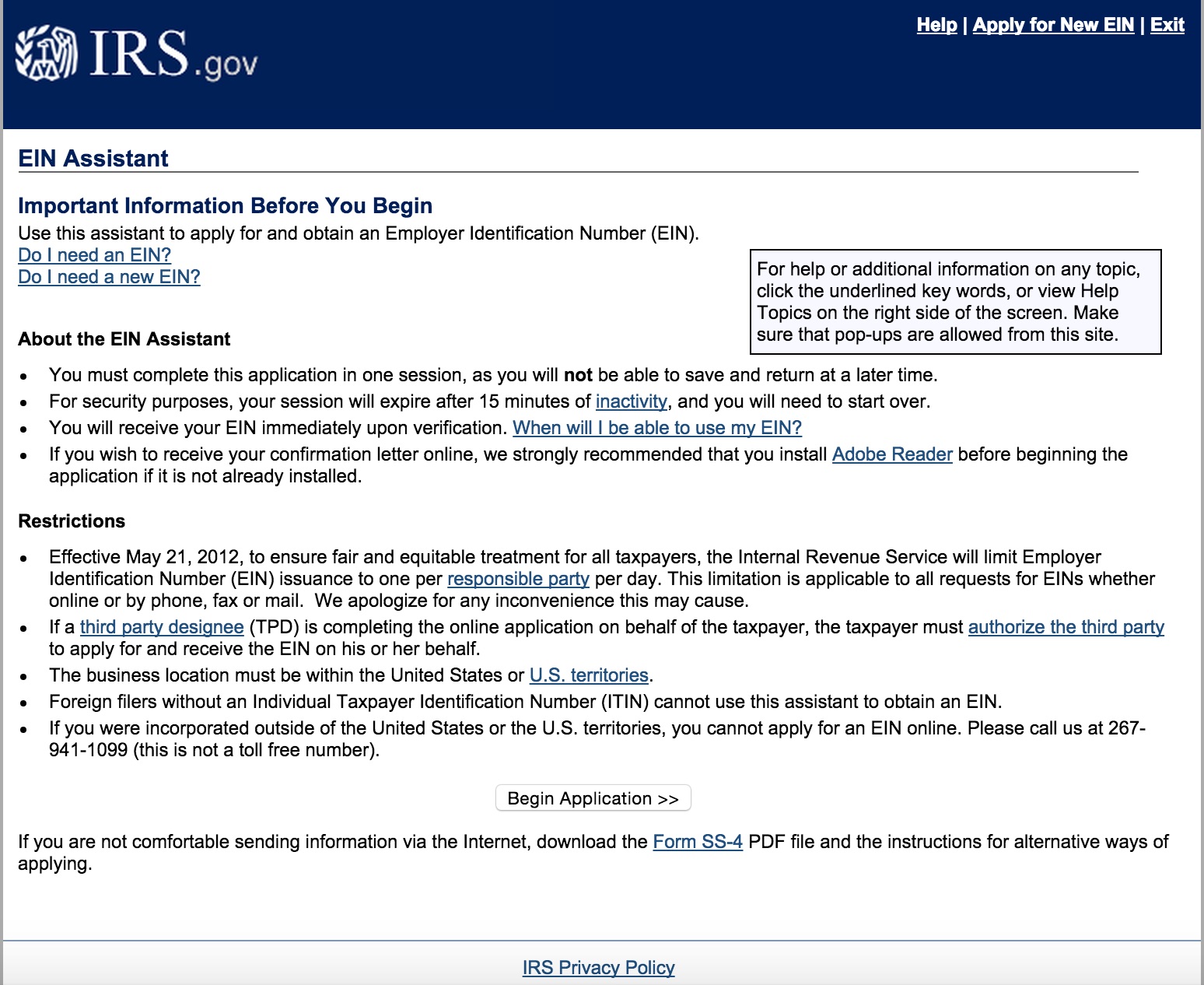

You can apply for an EIN on-line by mail or by fax. The IRS makes it simple to apply for and obtain an EIN. Fax the completed SS-4 application form to your state fax number.

This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. You can then download save and print your EIN confirmation notice. An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity.

The hours of operation are 700 am. Your options for doing so include applying online through fax via mail and over the telephone. An EIN number allows you to hire employees maintain your corporate veil and more.

Internal Revenue Service IRS. All non-profit EINs are. You can apply for an EIN online by fax by mail.

Applying for an EIN is straightforward but there are some nuances depending on where your business is based. You can apply to the IRS for an EIN in several ways. To find the EIN of a public company go to the SECs Electronic Data Gathering Analysis and Retrieval EDGAR database type the company name and press Search In the search results locate the correct company and look through its filed documents for a Form 10-Q or Form 10-K.

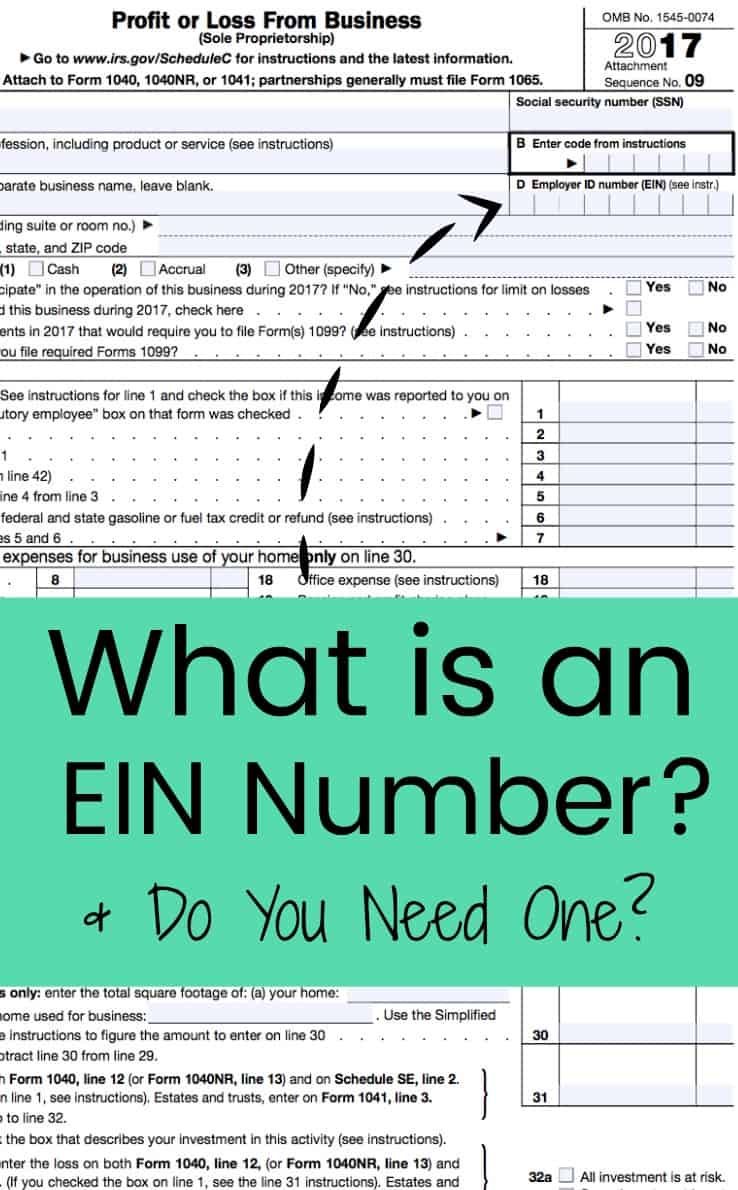

Search the companys name and pull up the most recent 10-Q or 10K. To reduce any stress associated with the application process let us do the hard work. An Employer Identification Number EIN is like a social security number for your business.

Find a previously filed tax return for your existing entity if you have filed a return for which you have your lost or misplaced EIN. Its similar to a Social Security number but is meant for business related items only. Number for further details.

To apply for an employer identification number you should obtain Form SS-4 PDF and its Instructions PDF. How to Get an EIN. See the instructions PDF for Form SS-4 Application for Employer ID.

If you really cant find your EIN on the previously mentioned documents you can contact the IRS but youll need to call them between 7 am. By phone fax or mail or online. How do I get an Employer Identification Number EIN for my organization.

Local time Monday through Friday. No matter what kind of business you have it is usually a good idea to get one. Eastern Time Monday through Friday to obtain their EIN.

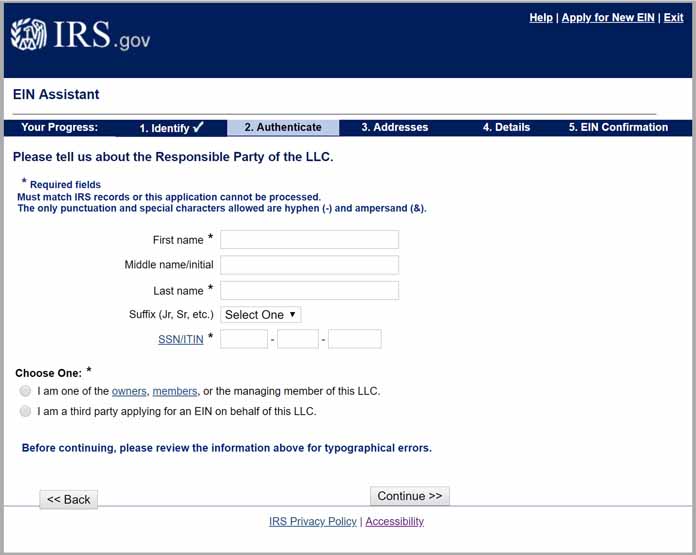

How to Obtain an Employer Identification Number EIN Self English Go to page 2 Spanish Go to page 18 Third party English Go to page 34. Complete the Third Party Designee section only if you want to authorize the named individual to receive the entitys EIN. If your EIN has changed recently and it is likely that your EIN is different on older documents this should be your first option.

Make sure that you select church or church-controlled organization or other nonprofit organization as the type of entity. Be sure that the person contacting the IRS is authorized someone like. As a business owner youll need an EIN to open a business bank account apply for business licenses and file your tax returns.

International applicants may apply by phone. An assistor will ask you for identifying information and provide the number. Employer Tax Responsibilities Explained Publications 15 15-A and 15B.

The EIN allows the IRS to keep track of a businesss tax reporting. Social Security Number SSN getting an Employer Identification Number is easy by applying online see below. Its helpful to apply for one as soon as you start planning your business.

No entities are excluded from obtaining an EIN. Ask the IRS to search for your EIN by calling the Business Specialty Tax Line at 800-829-4933. After all validations are done you will get your EIN immediately upon completion.

If you include your fax number you will receive your EIN by fax within four business days. Contact the IRS to Find Your EIN. The person making the call must be authorized to receive the EIN and answer questions concerning the Form SS-4 PDF Application for Employer Identification Number.

If your business changes its entity structure such as changing from an LLC to an S corp a new EIN is required because a new tax ID is. Employer Identification Number EIN also known as Tax ID or Taxpayer Identification Number is a number for your business assigned by the US. If you have a US.

Your previously filed return should be notated with your EIN. Filing online using the IRS EIN Assistant online application is the easiest way. You can get your number immediately using the online or phone option.

Probably the simplest way and definitely the fastest is to apply online. Employer Identification Number on Netflixs recent 10-Q.

Ein Comprehensive Guide Freshbooks

Ein Comprehensive Guide Freshbooks

Employer Identification Number Ein Business Tax Id Number

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

Ein Lookup How To Find Your Business Tax Id Number Nerdwallet

How To Get A Tax Id Number Ein For Probate

How To Get A Tax Id Number Ein For Probate

How To Apply For An Employer Tax Identification Number Ein Start Your Small Business Today

How To Apply For An Employer Tax Identification Number Ein Start Your Small Business Today

What Is An Ein Number Do You Need One Cutting For Business

What Is An Ein Number Do You Need One Cutting For Business

Ein Comprehensive Guide Freshbooks

Ein Comprehensive Guide Freshbooks

Ein Number What Is An Ein Truic

Ein Number What Is An Ein Truic

Get An Irs Ein Number The Definitive Step By Step Guide

Get An Irs Ein Number The Definitive Step By Step Guide

How To Get A Tax Id Number If You Re Self Employed Or Have A Small Business Business Insider

How To Get A Tax Id Number If You Re Self Employed Or Have A Small Business Business Insider

Ein Number What Is An Ein Truic

Ein Number What Is An Ein Truic

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

How To Find Your German Tax Id Steuer Id Steuernummer And Vat Number All About Berlin

How To Get An Ein Number Guide To Ein Numbers For Your Llc

How To Get An Ein Number Guide To Ein Numbers For Your Llc

Comments

Post a Comment