Ssdi Taxable Income Calculator

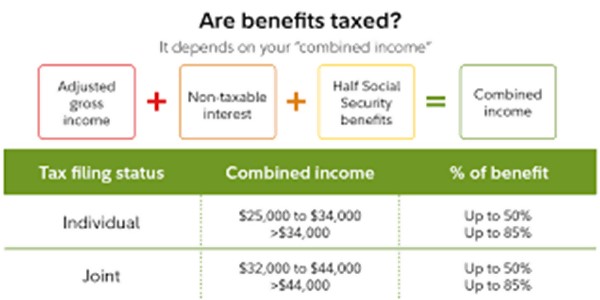

For incomes of over 34000 up to 85 of your retirement benefits may be taxed. If your total income is.

Is Ssdi Taxable Income Page 4 Line 17qq Com

Is Ssdi Taxable Income Page 4 Line 17qq Com

Subtract the 50 taxation threshold for the individuals tax filing.

Ssdi taxable income calculator. 1040 Tax Calculator Share. SSDI Calculator Get a quick estimate for your monthly Social Security Disability Insurance SSDI benefits payment. Please keep in mind that this is only an estimated number.

We assume that your income in the future increases by the rate if inflation and your income in the past is discounted by the same inflation rate Indexed Earnings. If this is the case you may want to consider repositioning some of your other income to minimize how much of your Social Security Benefit may be taxed and thereby maximize your retirement income sources. The taxable portion of the benefits thats included in your income and used to calculate your income tax liability depends on the total amount of your income and benefits for the taxable year.

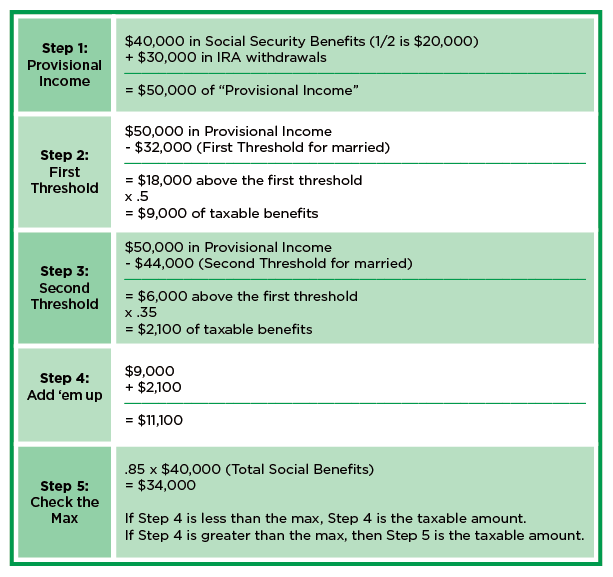

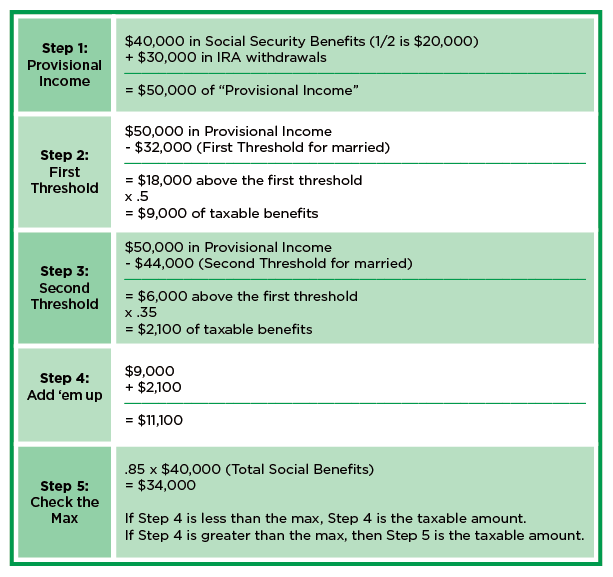

Fifty percent of a taxpayers benefits may be taxable if they are. Between the base and maximum amount your Social Security income is taxable up to 50. Divide their Social Security benefits 12000 in half to get 6000.

Most states do not tax SSDI benefits but 13. You report the taxable portion of your social security benefits on line 6b of Form 1040 or Form 1040-SR. We assume that you have worked and paid Social Security taxes for 35.

Above the maximum amount your Social Security benefits are taxable up to 85. Under the Social Security Disability Insurance program your disability benefits will be based on your average lifetime earnings prior to disabilityThe SSA has a complex formula in calculating SSDI benefits and they tweak it each year. For the purposes of taxation your combined income is defined as the total of your adjusted gross income plus half of your Social Security benefits plus nontaxable interest.

Enter your filing status income deductions and credits and we will estimate your total taxes. The calculations are done on the IRS Form 1040 tax return or you can use Social Securitys tax calculator. Did you know that up to 85 of your Social Security Benefits may be subject to income tax.

If your total income including SSDI benefits is higher than IRS thresholds the amount that is over the limit is subject to federal income tax. To give you an idea the average SSDI amount in 2018 is 1197 per month and the maximum amount is 2788. If your income is above that but is below 34000 up to half of your benefits may be taxable.

When a disabled or blind child under age 18 lives with parents or a parent and a stepparent and at least one parent does not receive SSI benefits we may count. Right now the average for. Benefit estimates depend on your date of birth and on your earnings history.

When a person who is eligible for SSI benefits lives with a spouse who is not eligible for SSI benefits we may count some of the spouses income in determining the SSI benefit. Youd calculate the amount theyd owe taxes on this way. Married filing jointly with 32000 to 44000 income.

Filing single single head of household or qualifying widow or widower with 25000 to 34000 income. We use the Social Security Administrations National Average Wage Index to index wages for the social security benefit calculation Working Years. Enter total annual Social Security SS benefit amount box 5 of any SSA-1099 and RRB-1099 Enter taxable income excluding SS benefits IRS Form 1040 lines 1 2a 2b 3b 4b 4d 5b and 6a and Schedule 1 form 1040 line 9.

A The portion of income between 32000 and 44000 is taxed according to the pre-93 rules at 50 amounting to 6000 of taxable social security 44000-32000 12000 x5 6000 B The provisional income over 44000 joint is taxed according to the post-93 rules at 85. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April. Below the base amount your Social Security benefits are not taxable.

Earnings from jobs covered by Social Security are used to determine the amount of monthly SSDI benefits payments. If you have over 2083 in income per month calculating the actual amount of SSDI benefits that will be taxed can be quite complicated. It is not based on how severe your disability is or how much income you have.

Married filing separately and lived apart from their spouse for all of 2019 with 25000 to 34000 income. Most SSDI recipients receive between 800 and 1800 per month the average for 2020 is 1258. If your provisional income is between 25000 and 34000 for a single filer or from 32000 to 44000 for a joint filer then up to 50 of your Social Security benefits may be.

A Closer Look At Social Security Taxation Jim Saulnier Cfp Jim Saulnier Cfp

A Closer Look At Social Security Taxation Jim Saulnier Cfp Jim Saulnier Cfp

How Do Dividends Affect Social Security Benefits Intelligent Income By Simply Safe Dividends

How Do Dividends Affect Social Security Benefits Intelligent Income By Simply Safe Dividends

Spreadsheet To Show How Taxable Ss Benefits Will Affect You Bogleheads Org

Social Security Benefits Tax Calculator Internal Revenue Code Simplified

Social Security Benefits Tax Calculator Internal Revenue Code Simplified

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

How Much Would You Receive From Disability Benefits Washington Post

How Much Would You Receive From Disability Benefits Washington Post

Is Social Security Taxable 2020 Update Smartasset

Is Social Security Taxable 2020 Update Smartasset

Taxable Social Security Calculator

Taxable Social Security Calculator

Spreadsheet To Show How Taxable Ss Benefits Will Affect You Bogleheads Org

Is Ssdi Taxable Income Page 1 Line 17qq Com

Is Ssdi Taxable Income Page 1 Line 17qq Com

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

Comments

Post a Comment