Can I Buy A Second Home

Property taxes insurance maintenance and repairs come along with the keys to a secondary property. You want to buy a second home.

Buying A Second Home Is It Right For You Nextadvisor With Time

Buying A Second Home Is It Right For You Nextadvisor With Time

Whether you want to generate regular rental income or invest in a longer-term real estate opportunity we can help.

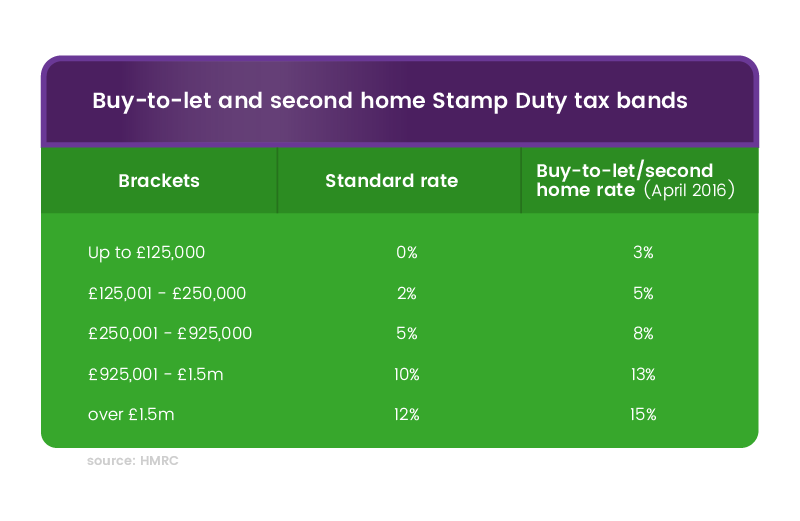

Can i buy a second home. You have to pay more stamp duty when you buy a second home than you pay when purchasing a primary residence. Technically the answer is no. If you have money to spend and you want to put it into real estate buying another home can be a great idea and an excellent investment.

If you get a mortgage for a holiday home you wont be able to rent it out. In most cases lenders will ask for a standard 20 down payment to fund the purchase of your second home. If youre intending to rent it out you should apply for a commercial loan.

Tenants come and go. They can also be used to acquire another vacation home. A popular misconception when buying a second home or even a primary home is a purchase requires 20 down.

Buy a Second Property. You can then apply for a second residential mortgage to help buy your new home. Exchanging a vacation home for investment property replacing an.

Buying a second home means taking on more than just mortgage costs. Whether youre investing in a rental property or a vacation home as a second property we can help you make the most of your purchase. There are two primary real estate investment strategies for buying a second home.

Here are several things you need to keep in mind. Selling Your Second Home If you sell your primary residence the law allows single taxpayers to exclude up to 250000 in capital gains from your income. Let Us Help You Buy A Second Property.

When properly done for many investors 1031 exchanges on second homes can be a great way to free up more working capital. Buying an Investment Property. While you cant use a VA loan to buy a second property that you intend to rent out and earn income on you could buy a new home that will become your primary.

Buying real estate as an. Hazard insurance may be higher in some resort locations such as beaches. However its important to make absolutely sure that you can afford it.

From this article you will learn how to use a 1031 exchange in two possible scenarios. Dharmesh Jain chairman and managing director of Nirmal Lifestyle points out that the advantage of buying a home for self-use is that the home buyer can move into or occupy the property at. Buying a second home can be worth it if you have sufficient disposable income.

Youll also have to explain the purpose of the second property. Rental income isnt guaranteed. Smaller down payments may be allowed if you meet specific financial requirements but a lower down payment might result in a less favorable interest rate which could end up costing thousands over the life of the loan.

Insurance yard and a pool can all factor into what the costs will be to carry the second home Plus getting second-home insurance may be more challenging than for a primary residence. When it comes to renting a second home you need to go into that commitment with eyes wide open. You can buy a second home with IRA money but there are some restrictions that you must know about.

Experts believe that one should buy a second home property for self-use only if they can commit themselves to spending a good deal of time at that home. To flip and resell it or to rent it out as a source of passive income. If withdrawn funds are not included in one of the penalty-free exclusions you will have to pay a 10 percent penalty on all funds that are withdrawn to make your purchase.

Your second home is an additional property or secondary residence. These special government-sponsored loans allow you to borrow money from your home without requiring repayment until you leavesell your home. Although buying a principal residence has more low to no down payment options such as VA FHA USDA or conventional options second home loan options are more vanilla but just because there are not as many options on a second home purchase it doesnt mean a lower down.

With current mortgage rates at a historic low you might be tempted to jump in. A reverse mortgage may be a viable option for financing a second home but only if youre aged 62 or older. When you buy a second home your original property becomes known as your primary residence or principal primary residence for tax purposes.

6 Things To Consider Before Buying A Second Home Finance Buddha Blog Enlighten Your Finances

6 Things To Consider Before Buying A Second Home Finance Buddha Blog Enlighten Your Finances

How To Buy A Second Home Your Questions Answered Sell House Fast

How To Buy A Second Home Your Questions Answered Sell House Fast

Using Equity To Buy A Second Property How To Buy With No Deposit

Using Equity To Buy A Second Property How To Buy With No Deposit

Buying A Second Home The 3 Biggest Factors To Consider

:strip_icc()/how-to-create-a-savings-budget-for-buying-a-second-home-4172780-Final3-bf0c6c2f7df64902bdb22e4b893ba8f6.png) How To Create A Savings Budget For Buying A Second Home

How To Create A Savings Budget For Buying A Second Home

How To Buy A Second Home Your Questions Answered Sell House Fast

How To Buy A Second Home Your Questions Answered Sell House Fast

Buying A Second Home Is It Right For You Ramseysolutions Com

Buying A Second Home Is It Right For You Ramseysolutions Com

Amazon Com Buying A Second Home Income Getaway Or Retirement 9781413309256 Venezia Craig Books

Amazon Com Buying A Second Home Income Getaway Or Retirement 9781413309256 Venezia Craig Books

How To Buy A Second Home 13 Steps With Pictures Wikihow

How To Buy A Second Home 13 Steps With Pictures Wikihow

Buying A Second Home Homeowners Alliance

Buying A Second Home Homeowners Alliance

Why You Should Buy A Second Home Iifl

Why You Should Buy A Second Home Iifl

6 Tips To Buying A Second Home As A Rental Or Vacation Property

6 Tips To Buying A Second Home As A Rental Or Vacation Property

5 Reasons To Buy A Second Home

5 Reasons To Buy A Second Home

Are You Going To Buy A Second Home Watch Out

Are You Going To Buy A Second Home Watch Out

Comments

Post a Comment