Who Are Underwriters For Mortgage

If you cannot fulfill the request from the underwriter then youll need to give them an honest explanation of why. How long does underwriting take.

Is Underwriting The Last Step In The Mortgage Process Hbi Blog

A mortgage underwriter is an insurance professional responsible for evaluating the risk of a mortgage application from the financial institution perspective.

Who are underwriters for mortgage. Yes underwriters are employees of banks lenders and mortgage bankers. After all if you ever need to sell you want to make sure you can get enough money for the property to pay off the mortgage. Underwriters are like real estate detectives.

Mortgage underwriting is the process during your mortgage application where the underwriters check what level of financial risk your lender would be taking by agreeing to give you a mortgage. I would confront the underwriter and say something like this. Professional underwriters use a series of checks to decide how likely it is that you will default on the mortgage loan youve applied for.

They make sure that all of the tax title insurance and closing documentation is in place. They forget to check some box omit a statement or miss a signature. Underwriters want to know that youre not spending and thus borrowing more than the property is worth.

The underwriter will investigate to make sure your application and documentation are truthful and they will double-check you have described your finances accurately. Youve prepared to apply for a mortgage. While your future home undergoes an appraisal a financial expert called an underwriter takes a look at your finances and assesses how much of.

Your loan underwriter is ultimately the person who decides whether or not you can qualify for a mortgage. In considering your application they look at a variety of factors including your credit history income and any outstanding debts. It might only take an underwriter a few hours to comb through a loan file and approve suspend or deny it.

Being a Mortgage Underwriter assesses risks to determine approval status. In other words the guidelines help prevent borrowers from later defaulting on their loan. Underwriters are a mortgage companys final line of defense helping ensure that borrowers are well-prepared to make payments.

An underwriter is the party that assesses and evaluates the risk of whatever their particular field has mortgage loan health policy investment etc and. Then see what happens. You hope you covered everything correctly but almost everyone messes something up.

Here are the details. The underwriter will take a good look at your mortgage application calculate a risk assessment and match it against your profile. An appraiser will research the home to tell the underwriter how much its truly worth.

Mortgage underwriting is the process when the lenders undertake an in-depth analyse regarding the risk of lending you money and make a final decision. Monitors property appraisal process. A mortgage underwriter is the person that approves or denies your loan application.

Lets discuss what underwriters look for in the loan approval process. In this job the mortgage underwriter is responsible for determining the maximum amount of mortgage granted. You saved a down payment.

Thats the quick answer. A Mortgage Underwriter underwrites mortgage loan applications and evaluates loans in order to maximize organizational profit and minimize risk or loss. Understand what they do and why they matter.

A mortgage underwriter is responsible for analyzing your risk to determine if the terms of your loan are acceptable. Guided by lender investor and federal requirements a mortgage underwriter will analyze your finances to make sure you arent a risky borrower. Its their job to make sure you have represented yourself and your finances truthfully and that you havent made any false or.

Your underwriter knows if youre a good candidate just from looking into how youve handled money in the past. Today trained underwriters follow strict black-and-white guidelines intended to protect borrowers from taking on more mortgage responsibility than is safe for them. They work on the operational side of things making loan decisions after the sales team brings the loan in the door.

Look you said 65000 was enough cash reserves during the pre-approval of the mortgage and thats all I have. It is the job of underwriters to make sure all of these factors meet particular loan guidelines. You hand this information over to your loan officer or a mortgage processor and the underwriters will review your documents for thoroughness completeness and accuracy.

An underwriter plays an important role in an insurance transaction or policy.

What Do Mortgage Underwriters Do The Truth About Mortgage

What Do Mortgage Underwriters Do The Truth About Mortgage

6 Steps Of Mortgage Loan Process Conditional Approval Guaranteed Rate

Mortgage Underwriting What Actually Happens Mojo Mortgages

Mortgage Underwriting What Actually Happens Mojo Mortgages

Department Highlight Underwriting

Department Highlight Underwriting

How Mortgage Underwriters Analyse Risk

What Does A Mortgage Underwriter Do

What Does A Mortgage Underwriter Do

What Is The Role Of The Mortgage Underwriter Houseopedia

What Is The Role Of The Mortgage Underwriter Houseopedia

What Is Mortgage Underwriting What Does Mortgage Underwriting Mean Youtube

What Is Mortgage Underwriting What Does Mortgage Underwriting Mean Youtube

Mortgage Underwriters Meaning Useful Factors Outcomes And More Efm

Mortgage Underwriters Meaning Useful Factors Outcomes And More Efm

/understanding-the-mortgage-underwriting-approval-process-2395236_final-a045fb3a570b448593cb32da8a15cecb.png) The Mortgage Underwriting Approval Process

The Mortgage Underwriting Approval Process

Automated Mortgage Underwriting Systems For Lenders Explained

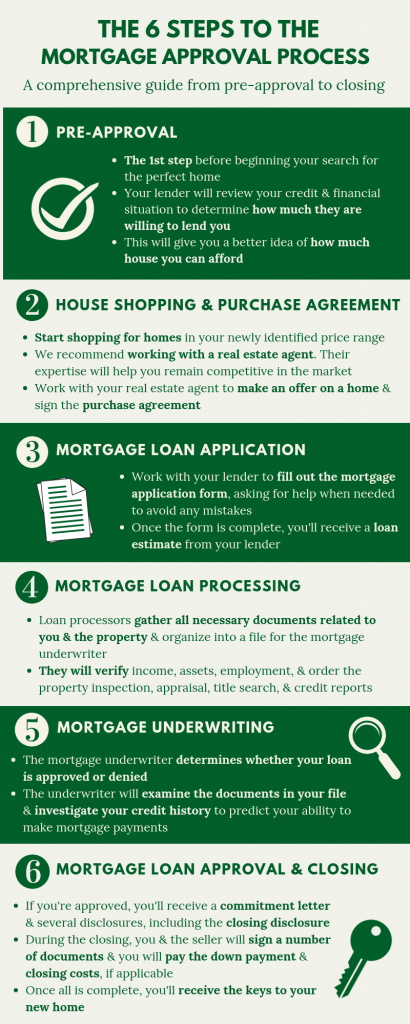

The 6 Steps To The Mortgage Approval Process Easy Mortgage Company

The 6 Steps To The Mortgage Approval Process Easy Mortgage Company

What Do Mortgage Underwriters Do The Truth About Mortgage

What Do Mortgage Underwriters Do The Truth About Mortgage

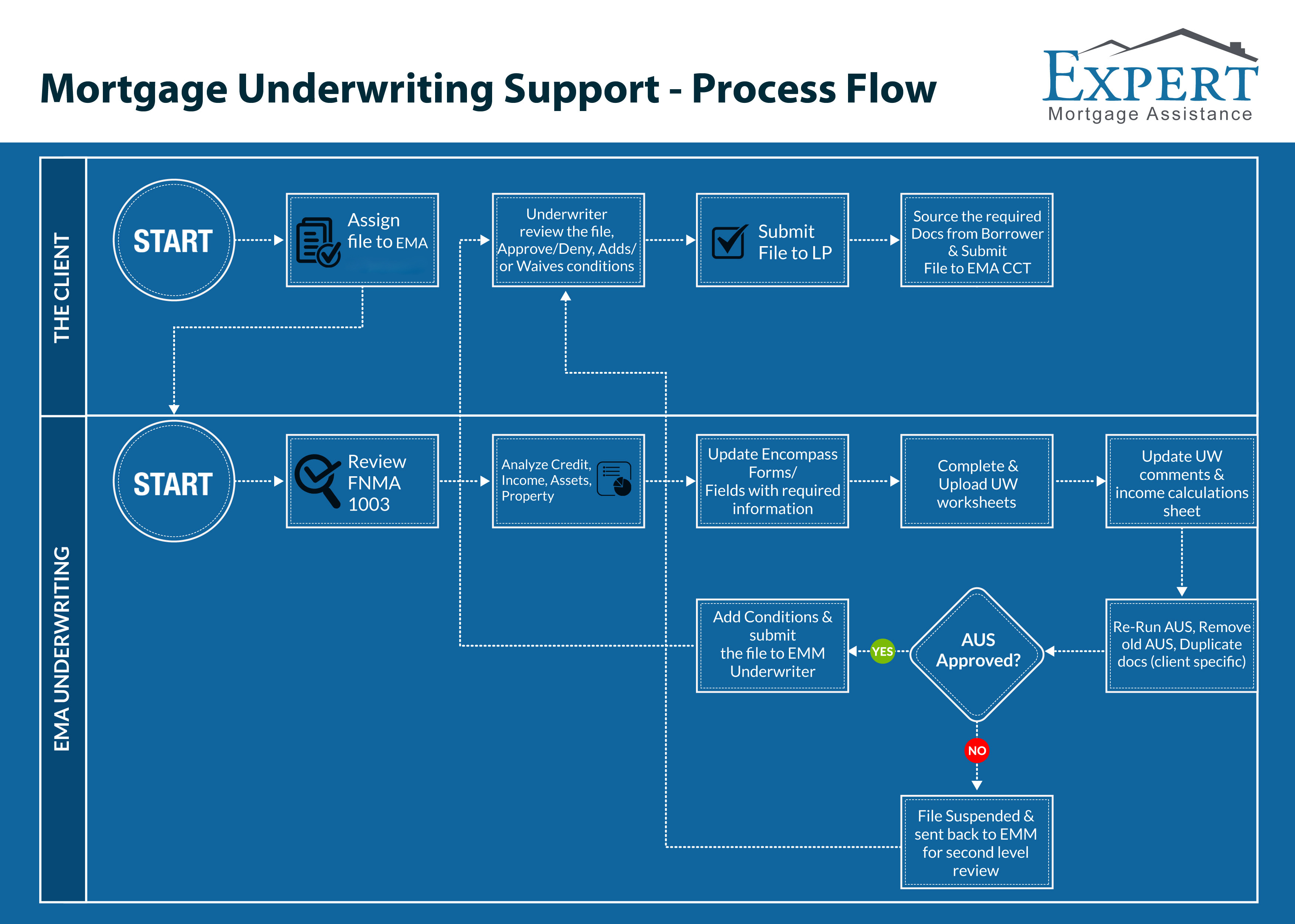

Mortgage Underwriting Process Outsourcing Services In Usa

Mortgage Underwriting Process Outsourcing Services In Usa

Comments

Post a Comment