Average Closing Cost On A House

The median price of homes that sold in the last year is 378600. Closing costs are typically about 3-5 of your loan amount and are usually paid at closing.

How Much Does It Cost To Sell A House Zillow

How Much Does It Cost To Sell A House Zillow

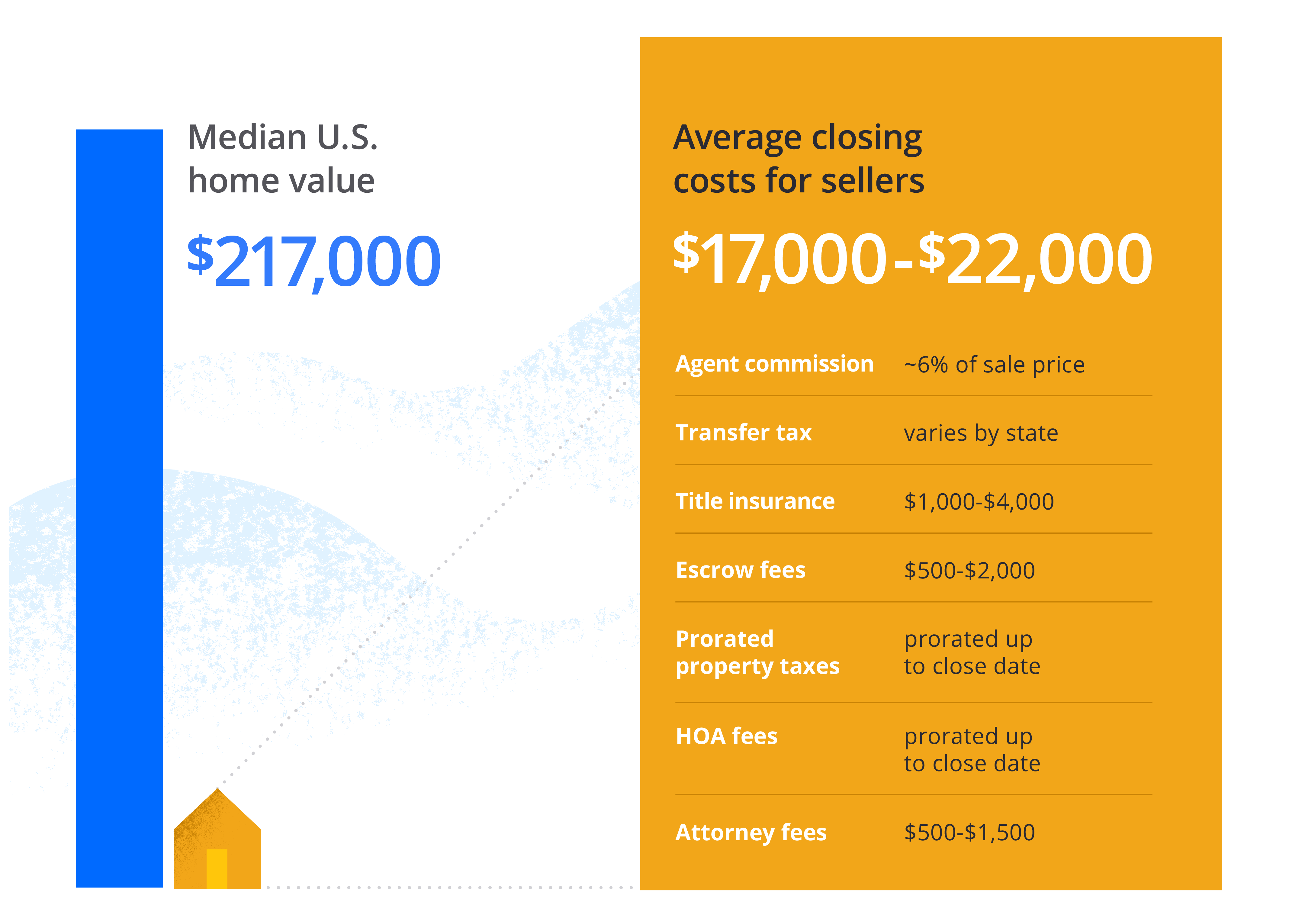

Seller closing costs are made up of several expenses.

Average closing cost on a house. And the figures arent for the faint-hearted. They report an average of 13357 for homes with a median value of 210200 and 4985 for important home preparation projects. True enough but even on a 150000 house that means closing costs could be anywhere between 3000 and 7500 thats a huge range.

If the buyer were to go with a lender she would have to pay the lender title fee mortgage origination fee and more. Typical closing costs for a buyer of a 250000 home might range between 5000 and 12500. You know how much you agreed to pay for your property.

The total buyer cost would be closer to 8500 instead of 531556. The total closing costs paid in a real estate transaction vary widely depending on the homes purchase price loan type and the lender you use. Policygenius can help you compare homeowners insurance.

The buyer closing cost of 531556 equals 03 the cost of the home 1750000 which is not bad. Home value of 244000 as of December 2019. On average buyers pay roughly 3700 in.

A median New Jersey home is worth 327500 so buyers can expect closing costs in the range of 6550 to 16375. If your closing costs are 3 that amounts to 11358. If you find a property within that price range expect to pay between 6300 and 7350 before taxes in closing costs.

The average closing costs for a seller total roughly 8 to 10 of the sale price of the home or about 19000-24000 based on the median US. So if your home cost 150000 you might pay between 3000 and 7500 in closing costs. Typically home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees.

An average of over 13000 USA Today ran a story this year detailing the average costs of closing on a home in the US. So what are all the other costs tacked on at the end. When including taxes that amount increased to 6087.

For example if we were to take the current median home value of 151700 according to Zillow data buyers in Michigan pay anywhere between 3034 and 7585. How much are closing costs. Why Title Insurance Is Important To Get.

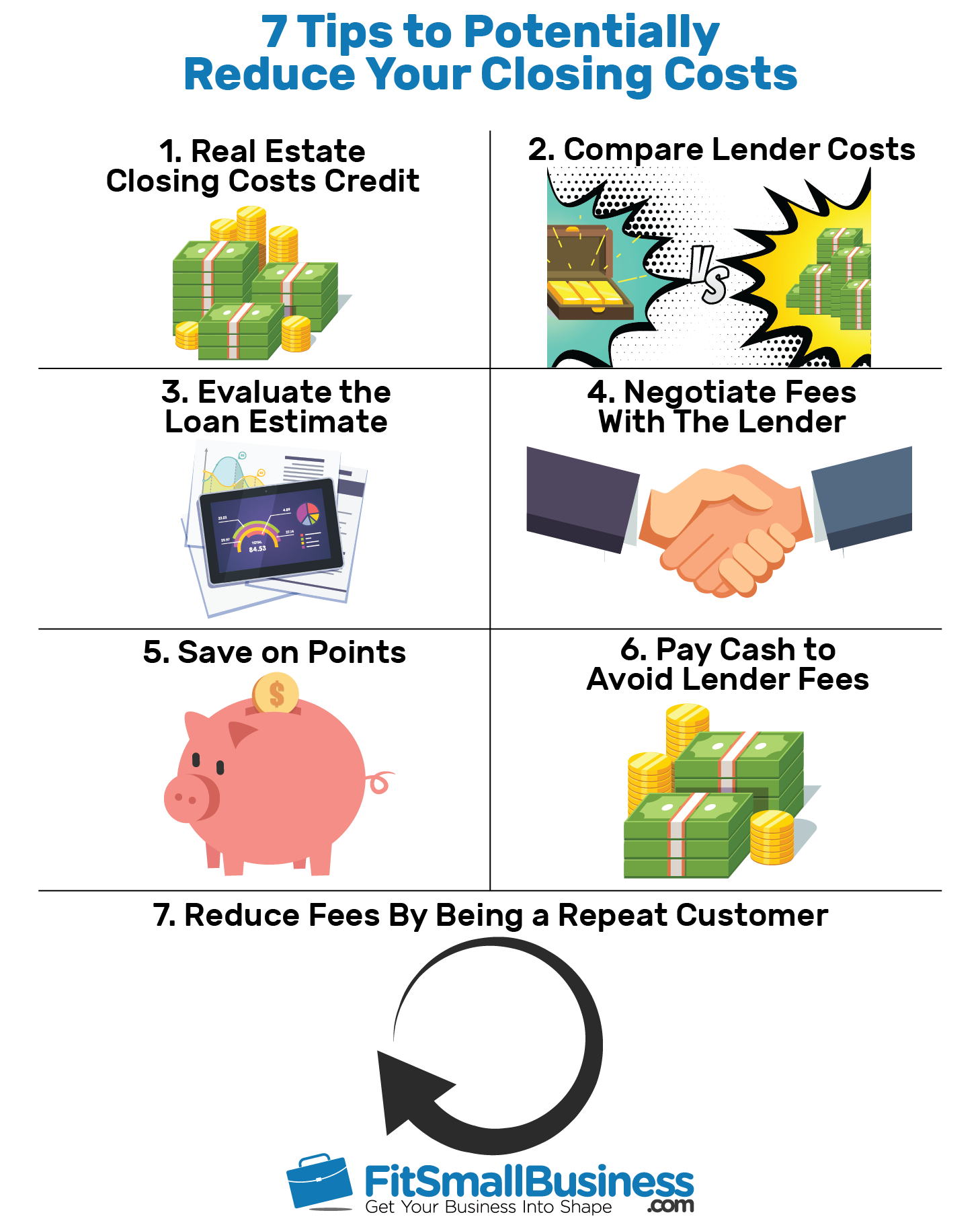

While each loan situation is different most closing costs typically fall into four categories. However the study didnt account for a number of variable costs including title search taxes escrow fees discount points title insurance and other government fees. These are called closing costs and they represent the fees associated with buying and selling a house.

A good rule of thumb is that closing costs will range between 2 and 5 of the homes final sale price. Whats the average closing cost on a house. These charges cover your inspection appraisal and origination costs as well as title insurance and courier fees.

Closing costs may be rolled into the loan amount or be paid at closing depending on the loan program. Heres a quick breakdown of potential costs and fees. While closing costs can be expensive one of.

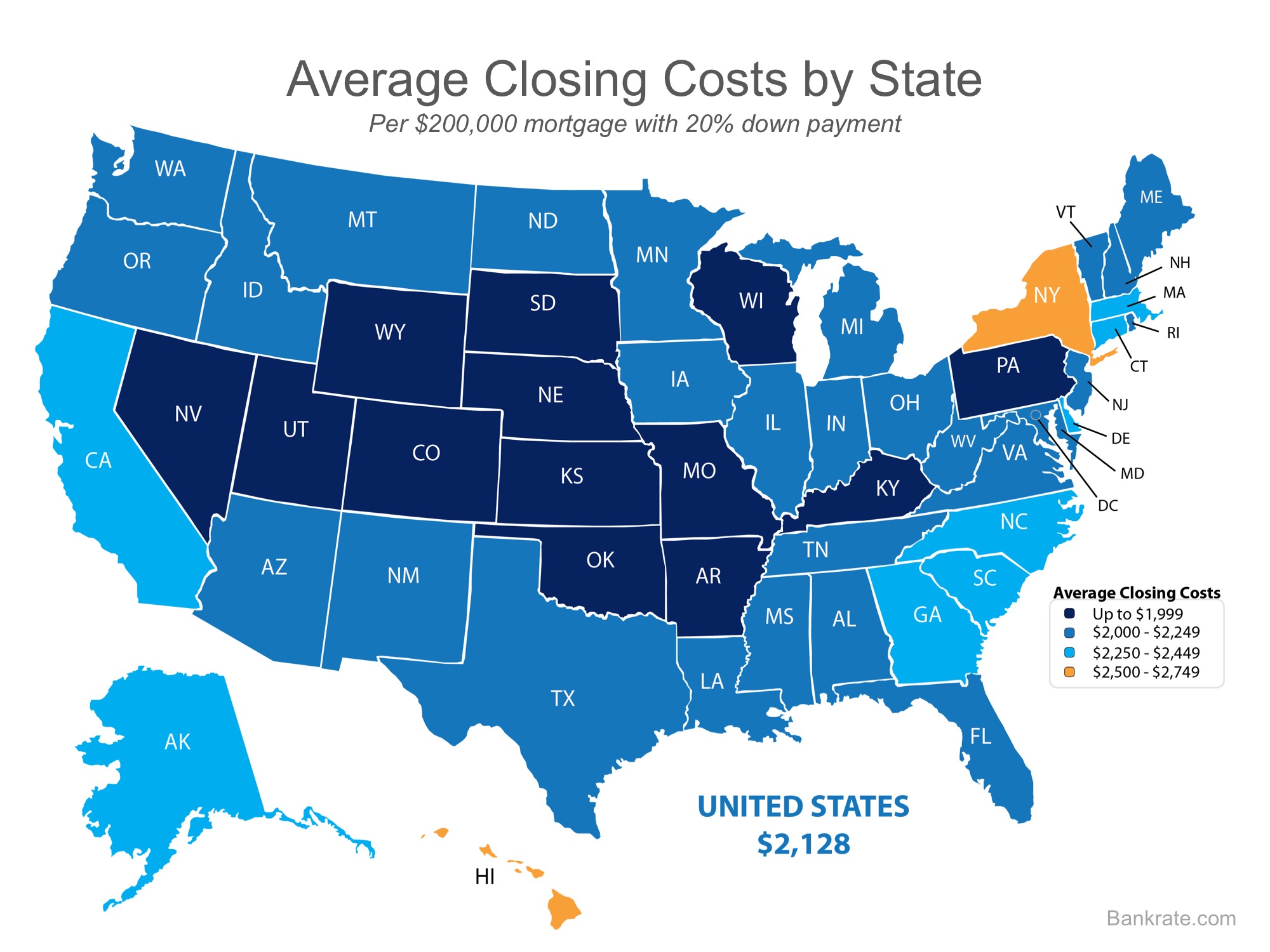

Find out right here. If you want to get in on the action dont forget to factor in closing costs. For a 200000 home the closing costs averaged 6590.

In South Carolina the average home. While closing costs can be expensive one of the largest mortgage expenses is the interest rate. The best guess most financial advisors and websites will give you is that closing costs are typically between 2 and 5 of the home value.

As a general rule buyers should expect to pay 25 of the total purchase price at closing. What Are Closing Costs. Average closing costs in California.

Buyer closing costs are often 2 to 5 of the home purchase price. In California the average home sells for 600000 to 700000. These costs cover underwriting title search and loan fees and are on top of the down payment.

The cost varies by location type of survey type of property and geographic and legal complications with thegeneral range being between 350 and 600. To ensure that you are fully prepared it is important to note that buyers will typically pay between 2 and 5 in closing costs. The average closing costs in 2020 were 3470 without taxes according to ClosingCorp data.

At the moment closing costs come to an average of 120 of the sales price which can quickly add up if youre paying top-dollar for your home. What is included in closing costs. Closing costs also known as settlement costs are the fees you pay when obtaining your loan.

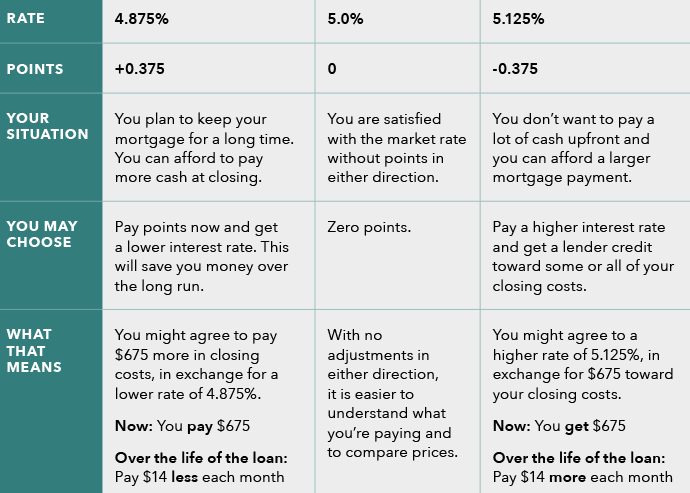

Over the life of the loan a few small percentage points can result in hundreds of thousands of dollars in interest payments.

Understanding Mortgage Closing Costs Lendingtree

Understanding Mortgage Closing Costs Lendingtree

Closing Costs Explained Home Closing 101

Closing Costs Explained Home Closing 101

Home Mortgage How Much Are Closing Costs Home Mortgage Center

Closing Costs Am I Paying Too Much

Closing Costs Am I Paying Too Much

Closing Costs Definition Types Average Amounts

Closing Costs Definition Types Average Amounts

How To Calculate Closing Costs On A Home Real Estate

How To Calculate Closing Costs On A Home Real Estate

What Are Typical Real Estate Closing Costs Ashley Howie Realtor

What Are Typical Real Estate Closing Costs Ashley Howie Realtor

How Much Are Mortgage Closing Costs

4 Things To Know About Closing Costs Compass Mortgage Llc

4 Things To Know About Closing Costs Compass Mortgage Llc

How Much Are Closing Costs For The Seller Opendoor

How Much Are Closing Costs For The Seller Opendoor

How Home Buyers Can Lower Closing Costs Wsj

How Home Buyers Can Lower Closing Costs Wsj

3 Ways To Estimate Closing Costs When Buying A House

Remember To Consider Closing Costs When Buying A Home Mccall Homes

Remember To Consider Closing Costs When Buying A Home Mccall Homes

Comments

Post a Comment