Are You Required To File Taxes

Low- and moderate-income Americans especially those who dont usually file a tax return can use the Free File program from the Internal Revenue Service to e-file their federal tax returns and get their refunds for free. If you find out you need to file a tax return learn how the process works when your return is due and more.

How Much Money Do You Have To Make To File Taxes 2015 Tax Return Fotografcilik

How Much Money Do You Have To Make To File Taxes 2015 Tax Return Fotografcilik

To file your taxes you must submit Form 1065 and Schedule K-1.

Are you required to file taxes. You owe tax to the CRA. You are self-employed and have to pay your Canada. The 5 rule for married taxpayers filing separate returns still applies as well.

If you earned below the minimum income for your filing status you may not be required to file a Federal Tax Return. Find out if you have to file a tax return. You only have to file a tax return if your income exceeds a certain threshold.

Again you must file a tax return if your combined unearned and earned income exceeds either of the applicable amounts. Although you are not required to file a tax return if your income is below the minimum filing threshold you may still wish to consider completing your paperwork. That threshold depends on your filing status.

The table below shows how. But you must file a tax return to claim a refundable tax credit or a refund for withheld income tax. You may not have to file a federal income tax return if your income is below a certain amount.

This interview will help you determine if youre required to file a federal tax return or if you should file to receive a refund. You must file a tax return for 2020 under any of the following circumstances if youre single someone else can claim you as a dependent and youre not age 65 or older or blind. Filing a federal return Many states will require you to file state taxes if youre also required to file federal taxes.

But one-member LLCs must report as if they were a sole proprietorship using Schedule C. Who Is Required to File an Income Tax Return. In this case they do not have to present Schedule K-1.

If you are the legal representative the executor administrator or liquidator of the estate of a person who died in 2020 you may have to file a return for 2020 for that person. If you have paid any tax during the year or if you are eligible for credits and deductions you. For example you would have to file if your gross income was more than 1100 or more than 12400 if youre unmarried and under the age of 65.

Under age 65 Single Dont have any special circumstances that require you to file like self-employment income Earn less than 12400 which is the 2020 standard deduction for a single taxpayer. You Must File an Income Tax Return if. For the tax year 2019 you will need to file a tax return if you are not married at least 65 years of age and your gross income is 13850 or higher.

We breakdown the minimum amount of money you have to earn before you are legally required to file a tax return. Corporations generally have to make estimated tax payments if they expect to owe tax of 500 or more when their return is filed. For example in 2020 you dont need to file a tax return if all of the following are true for you.

Your Canadian residency status doesnt affect whether or not you have to file a Canadian income. Having income over a threshold In some states youll only need to file if your income is above a certain threshold. In 2020 the IRS issued two Economic Impact Payments as part of the economic stimulus efforts.

This amount will vary state-by. If your income is above a threshold based on your filing status age and income you are required to file a federal income tax return. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is filed.

Making Money in Canada. If youre married and filing jointly but neither you nor your spouse is a dependent you must file taxes if your gross income exceeds 24800. Who Needs to File a Tax Return.

Filing Requirements for 2020 For the upcoming 2020 tax year if youre single youll need to file a tax return if your gross income exceeds 12400. For many people filing taxes shouldnt cost money. However there are reasons why you may still want to file.

But if you live on your Social Security benefits you dont include this in your gross income according to TurboTax. Your unearned income was more than 1100. Explore this storyboard about Taxes Personal Finance TurboTax by.

The first payments were up to 1200 person and 500 per qualifying child. The tax form reports the participation of each member in the business income deductions and tax credit items. Those thresholds vary quite a bit due to the different factors so heres a handy table to help you pinpoint the numbers that apply to you.

If you make more than the standard deduction for your age and filing status then you are required to file a tax return.

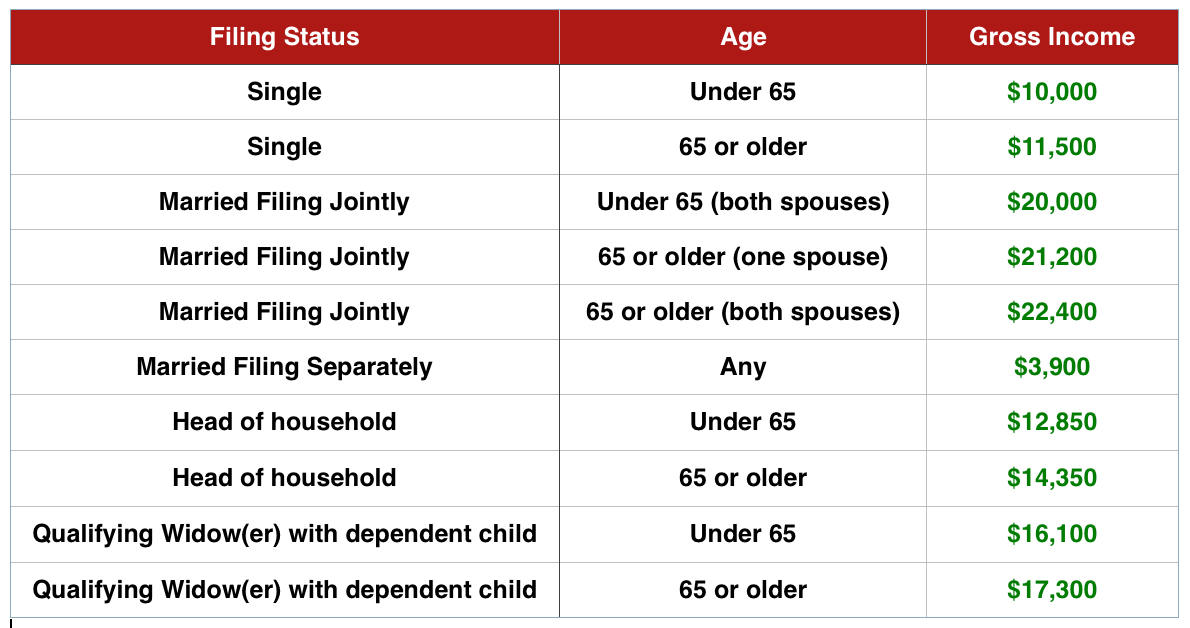

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

How Much Do You Have To Make To File Taxes In The U S Thestreet

How Much Do You Have To Make To File Taxes In The U S Thestreet

Do I Have To File Taxes Or Tax Return For 2020 Yes And No

Do I Have To File Taxes Or Tax Return For 2020 Yes And No

Do You Have To File A Dutch Income Tax Return

Do You Have To File A Dutch Income Tax Return

10 Compelling Reasons Why You Need To File Income Tax Returns

10 Compelling Reasons Why You Need To File Income Tax Returns

Do I Need To File A Tax Return Forbes Advisor

Do I Need To File A Tax Return Forbes Advisor

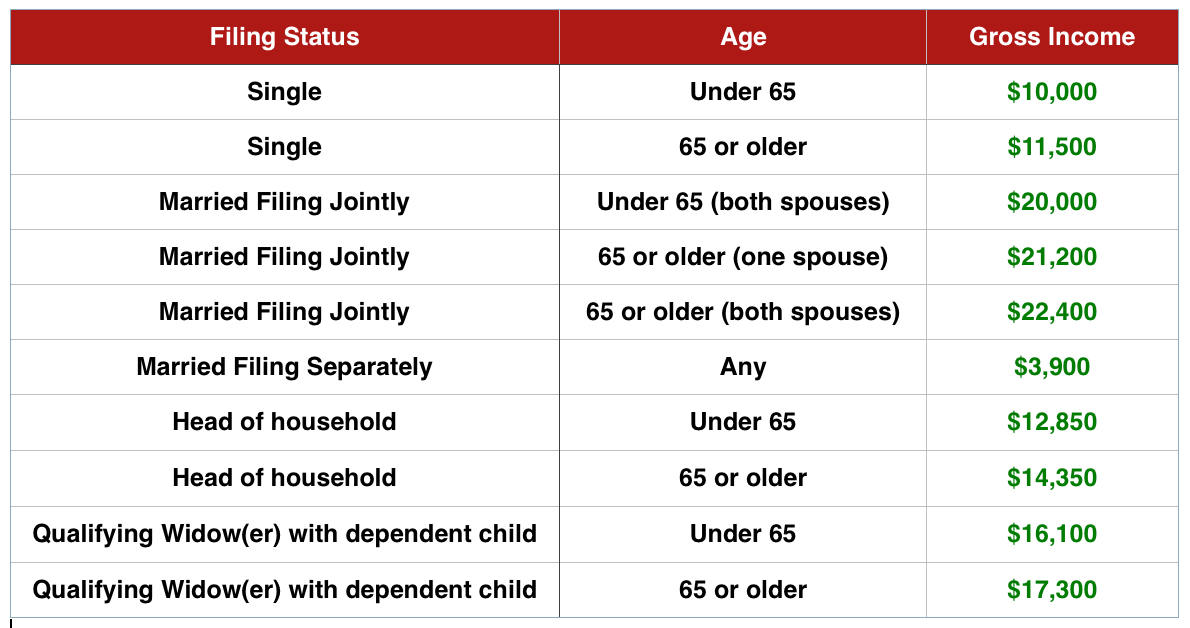

Do You Need To File A Tax Return In 2014

Do You Need To File A Tax Return In 2014

/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png) What Happens If You Don T File Taxes

What Happens If You Don T File Taxes

Do I Have To File Taxes And How Much Do I Need To Make

Do I Have To File Taxes And How Much Do I Need To Make

5 Tips For Filing Your Taxes For The First Time Taxact Blog

5 Tips For Filing Your Taxes For The First Time Taxact Blog

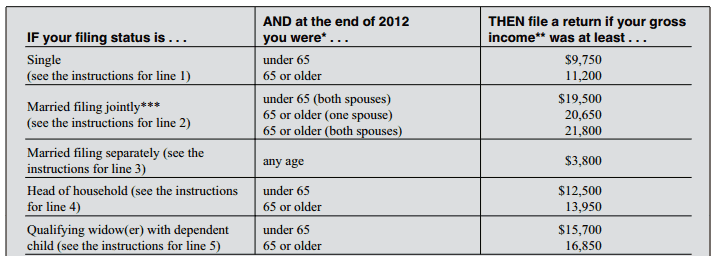

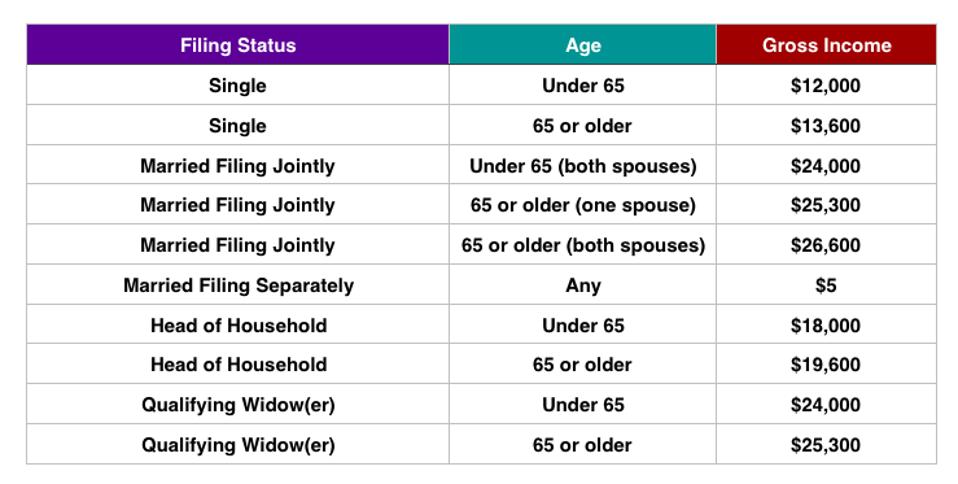

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

Who Is Required To File Income Tax Return

Who Is Required To File Income Tax Return

The Rules Requiring A Nonresident State Tax Return

The Rules Requiring A Nonresident State Tax Return

Comments

Post a Comment