Turbotax Child Tax Credit

If you have kids you might qualify for the Child Tax Credit which can reduce your tax bill by up to 2000 per qualifying child. The benefit uses your net family income to determine the amount you will received.

How To File Eitc And Child Tax Credit For Free Turbotax Edition

How To File Eitc And Child Tax Credit For Free Turbotax Edition

3600 for each qualifying child under 6.

Turbotax child tax credit. You enter a contract with a subscriber. The Child Tax Credit is one way you can directly reduce your taxable income by up to 2000 per quali. If you are under the age of 18 you may be eligible for an additional credit of up to 4909 or a total credit of up to 13325.

If you pay an IRS or state penalty or interest because of a TurboTax calculation error well pay you the penalty and interest. Quebec residents can apply for a similar credit called Tax Credit for Childrens Activity. The credit allows you to apply for 500 in fees paid per child and another 500 per child who is suffering from infirmity or disability.

However you may be able to claim a refundable Additional Child Tax Credit for the unused balance. This brings your tax bill down to 700 2400 - 1700. You can claim 5000 for a disabled child over the age of 16 who does not qualify for the disability tax credit but was still dependent on you and required care.

This not only eliminates the entire 700 of tax but also gives you a 100 tax refund. Up to 35 of qualifying expenses of 3000 for one child or dependent or. This is the first time that families with children age 17 will be eligible for this credit.

100 Accurate Calculations Guarantee. However the Child Tax Credit changed dramatically when the Tax Cuts and Jobs Act of 2017 was enacted. To qualify for the Child Tax Credit your child must fit all of these requirements.

Thanks to the American Rescue Plan which was enacted in March this years child tax credit for many families is increased from 2000 per child to 3000 per kid 3600 for children. If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax. If you file using TurboTax the program runs the numbers for you and picks the option that results in the largest tax credit.

Starting in tax year 2018 the Child Tax Credit increased. Starting in 2021 the taxes you file in 2022 the plan increases the Child Tax Credit from 2000 up to. Maximum Refund Guarantee - or Your Money Back.

When Americans file their taxes they can claim the credit for children under 17. 3000 per child under 17 and 3600 per child under 6. Up to 1400 per qualifying child is refundable with the Additional Child Tax Credit.

You first reduce the tax by the 1700 of nonrefundable credits you claim 500 for the Child and Dependent Care Credit plus 1200 for the American Opportunity Credit. For disabled dependent children of any age who qualify for the disability tax credit the amount to claim for that child is 11000. The new child tax credit will temporarily increase the amount of money parents get by up to 1600 more per child.

3000 for each qualifying child age 6 to 17. Be under age 17 at the end of the tax year. Please see this link for eligibility and how to apply.

The 2017 Tax Cuts and Jobs Act aka tax reform doubled the per-child credit amount from 1000 in 2017 and prior tax years. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy. The Canada Child Benefit CCB is a tax-free monthly payment made to eligible families to help them with the cost of raising children under the age of 18.

The Child Tax Credit is nonrefundable. The current credit is income-based so those making over 200000 400000 for married couples filing jointly will see the amount of their credit gradually phased out. You can start saving for your childs education from day one.

The Child Tax Credit has not had any changes for 2020 compared with 2019. If you paid a daycare center babysitter summer camp or other care provider to care for a qualifying child under age 13 or a disabled dependent of any age you may qualify for a tax credit of. You then reduce the 700 by the 800 refundable portion of your American Opportunity credit.

Child Tax Credits if youre responsible for one child or more - how much you get tax credit calculator eligibility claim tax credits. 5000 per child for children aged 7 to 16 years. Unemployment Income reported on a 1099-G.

If your credit exceeds your tax liability your tax bill is reduced to zero and any remaining unused credit is lost. If you personally qualify for the DTC you may claim 8416 for the disability amount on line 31600 of your Schedule 1. If taxpayers credit exceeds their taxes owed they can get up to.

The TurboTax Blog Child Tax Credit Child Tax Credit Learn more about the Child Tax Credit including its qualifications and how much it can boost your tax refund. Learn how the child tax credit may increase your tax refund with this. Child Tax Credit changes from prior years.

Theres already a child tax credit in place that provides 2000 per child for 2020. Registered Education Saving Plan RESP Worried about your childs future.

A Guide To Child Tax Benefits The Turbotax Blog

A Guide To Child Tax Benefits The Turbotax Blog

How To Claim Child Tax Benefit Turbotax Canada 2020 Youtube

How To Claim Child Tax Benefit Turbotax Canada 2020 Youtube

Turbotax Deluxe Cd Download 2020 2021 Tax Software Maximize Your Tax Deductions

Turbotax Deluxe Cd Download 2020 2021 Tax Software Maximize Your Tax Deductions

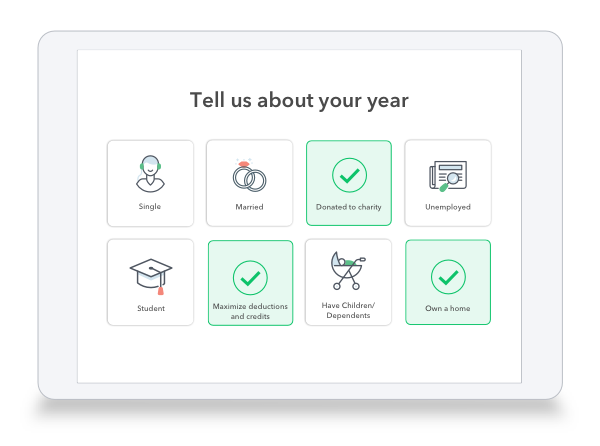

Turbotax Review 2021 The Easiest Tax Software To Use

Turbotax Review 2021 The Easiest Tax Software To Use

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

Turbotax Self Employed 2020 2021 Taxes Uncover Industry Specific Deductions

How To File Eitc And Child Tax Credit For Free Turbotax Edition

How To File Eitc And Child Tax Credit For Free Turbotax Edition

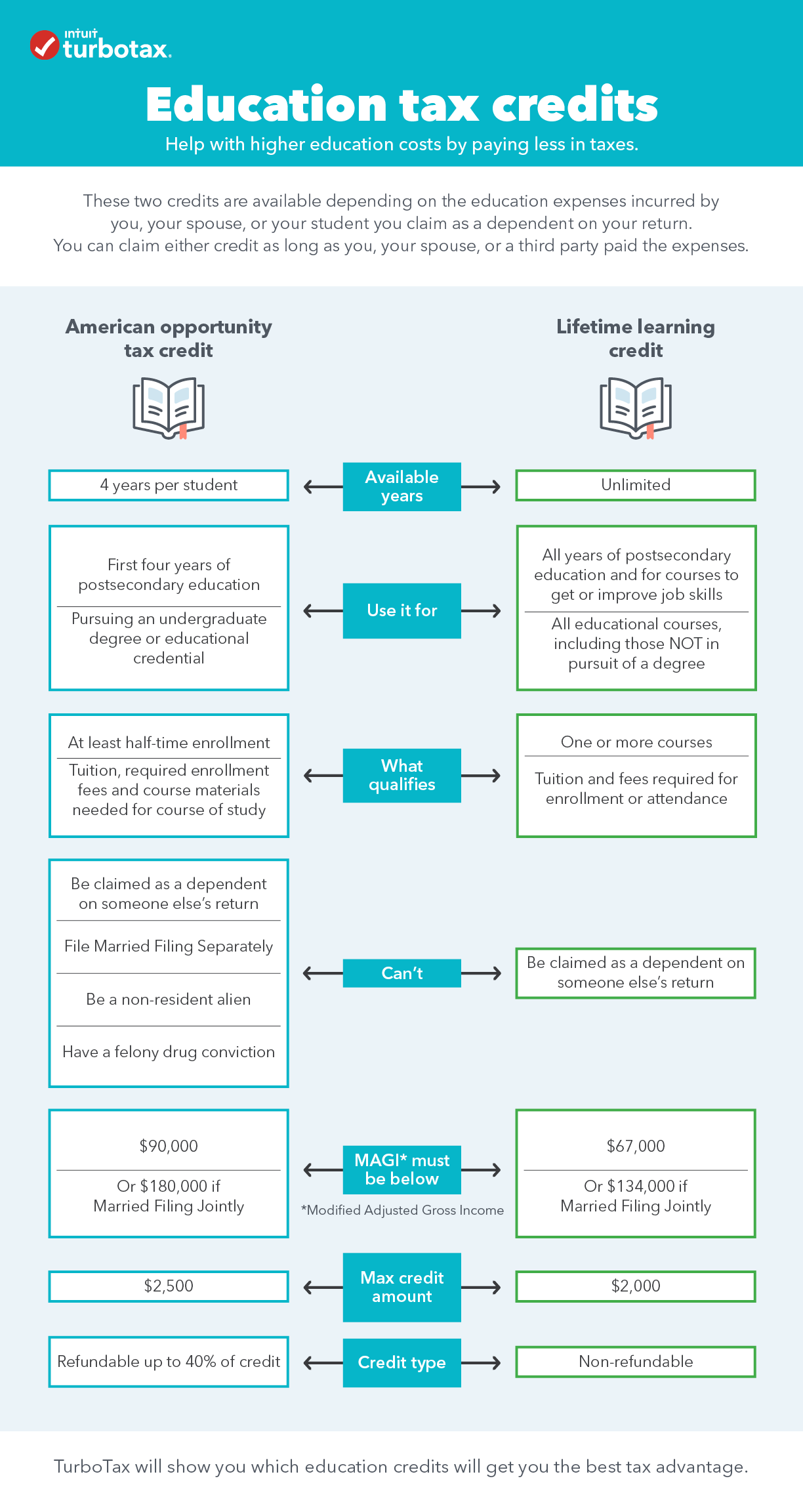

What Education Tax Credits Are Available

What Education Tax Credits Are Available

Turbotax Deluxe Online 2020 2021 Maximize Tax Deductions And Tax Credits

Turbotax Deluxe Online 2020 2021 Maximize Tax Deductions And Tax Credits

Best Tax Filing Software 2021 Reviews By Wirecutter

Best Tax Filing Software 2021 Reviews By Wirecutter

5 Facts About The Earned Income Tax Credit Turbotax Tax Tips Videos

5 Facts About The Earned Income Tax Credit Turbotax Tax Tips Videos

Intuit Turbotax 2021 Tax Year 2020 Review Pcmag

Intuit Turbotax 2021 Tax Year 2020 Review Pcmag

Child Tax Credit Turbotax Tax Tips Videos

Child Tax Credit Turbotax Tax Tips Videos

What Is The 2021 Child Tax Credit Under Stimulus Relief The Turbotax Blog

What Is The 2021 Child Tax Credit Under Stimulus Relief The Turbotax Blog

Comments

Post a Comment